Examining Spotify’s master plan for audio domination

From new forms of content to hardware development, Spotify is serious about diversification. Where will it go next ?

Credits: Bjorn Lindberg

Spotify is no longer just a music streaming platform

As Spotify prepares for its upcoming IPO, its CEO Daniel Ek took his letter to investors as an opportunity to redefine the company’s mission.

Below is a breakdown of the most significant parts, and what they mean:

Music has just been the beginning. We’re an audio first platform — as a top provider of podcasts, we’re also connecting audiences to the conversations that we think will shape the future.

Good ol’ music streaming Spotify is expanding its playground. Besides podcasts, a format Spotify has been playing with for some time, this could mean everything from audiobooks to live, “appointment” entertainment, something like the audio equivalent of HQ Trivia.

But “audio first” isn’t the same as “audio only”. In January, it announced Spotlight, a multimedia format “which introduces visual layers to complement the listening experience for podcasts, audiobooks, news, and other audio content.” With this new statement, Spotify just confirmed that it’s got its eyes on the video realm too.

Professional creators must be able to earn a fair living doing what they love, where monetization is at the core of a creative proposition and not an afterthought.

Revenue sharing has always been a touchy issue for streaming services, with both artists and their labels raising the matter to the public eye so as to renegociate the terms of their deals. The discontent was enough to lead some of the world’s leading artists to launch their own streaming company, Tidal, in 2015.

It’s not just about the revenue share, though. Doing any kind of creative work is challenging, yet the economic reward only comes with mainstream recognition and commercial success. Whatever platform they’re on, it takes a lot of streams for an artist to even make it. A small crowd of early adopters just isn’t enough if you depend only on streaming.

Therefore between the act of creation and monetization is a time and money gap that can wear creators down and deter them from pursuing. It seems that Spotify intends to solve that problem by being the support and payment infrastructure that will make creative work financially sustainable from Day 1.

How it intends to do it isn’t exactly clear. Spotify could enable tip jars and artist-specific subscriptions, something that is working wonders for video creators on Twitch. This would provide a steadier revenue stream by turning listeners into patrons. Or it could put to use the “attribution engine” developed by Mediachain, a blockchain company it acquired in April 2017.

That’s our mission — to unlock the potential of human creativity — by giving a million creative artists the opportunity to live off their art and billions of fans the opportunity to enjoy and be inspired by it.

There’s a lot happening there! What’s is striking is that this far exceeds Spotify’s initial mission, which focused only on the end consumer, meaning the delivery experience.

But Spotify doesn’t just want to support creators. It wants to turn them into customers, too.

Until now, the company has only monetized users (through ads and premium subscriptions) and brands (through branded operations). It gave artists access to merchandising and analytics tools for free, because it first needed to convince them to spend their time and efforts on the platform. But it doesn’t need to convince them anymore. Now, everyone wants to be on Spotify.

If it can build the end-to-end creator platform it envisions, Spotify will have something every artist can only dream of. Something it can finally start charging artists for.

Clearly, Spotify has big plans. So how does it get there?

As always with Spotify, the answer lies in a mix of internal and external growth. On the one hand, the company’s present initiatives in terms of product development hint to a much more diverse business model in the future. On the other hand, Spotify will likely acquire external technologies to accelerate its strategy.

Internal growth: Product enhancements

Podcasts

Daniel Ek says it best, Spotify is “an audio first platform.” The company has progressively widened its initial focus on music and is now leveraging audio in all its forms.

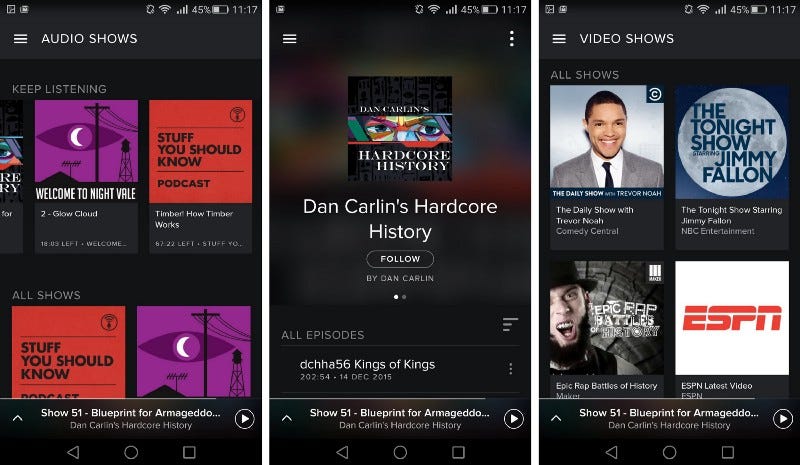

Podcasts play a key role in this master plan. Spotify distributes existing shows on its platform since 2016, commissionned original programs last year, and recently came up with a new podcast format that includes a video component.

Betting big on podcasts (Credits: Spotify)

For Spotify, podcasts are a way to test its users’ taste for formats other than music. The offer today is diverse enough to appeal to all sorts of audiences and they can generate high levels of engagement as podcast listeners tend to remain loyal to their favorite shows. Which means plenty of monetization opportunities.

Podcasts will serve as the first building block on the path to audio diversification. Ultimately, Spotify could become the leading provider of audio entertainment, starting with music, podcasts, then serial audio drama, and social games.

Voice technology

This month, the company started testing a voice assistant that lets you control your music through vocal commands only.

But before its assistant can understand more casual commands, for instance that “Yeezy” means “Kanye West”, Spotify needs you to actually link one to the other.

Credits: Spotify

That’s why this month it announced the launch of Line-In, a new platform that lets you recommend metadata for songs, albums, and artists. Spotify users can suggest moods, genres and even aliases that will enrich Spotify’s understanding of the content on its platform. With this new feature, the company is basically crowdsourcing the ground work of content tagging and association.

Spotify’s massive trove of data could help it develop the best-in-class assistant for the music vertical, rather than trying to catch up with generic assistants such as Amazon’s Alexa or Google Assistant.

Hardware

This involvement in voice technology sheds a new light on the jobs listings mentioning hardware developments on Spotify’s job board in February this year.

From these listings, Spotify has been hard at work building voice-enabled devices, a new hardware category “akin to Pebble Watch, Amazon Echo, and Snap Spectacles.”

As a software company, Spotify has mostly relied on third-parties to distribute its service. It’s proven to be a paying strategy. Spotify being the leading streaming platform today, manufacturers can’t afford to do without it — some have even developed products specifically for Spotify users.

But now Apple is barring HomePod owners from using anything but Apple Music, Amazon is making some voice commands to Alexa exclusive to Amazon Music users, and hardware makers such as Sony are opting for Google Assistant. Hardware could soon become a major blocking point for Spotify.

To preserve its connection with customers, Spotify needs its own physical touchpoint. Whether this ends up being a smart speaker or a pair of ear buds is anyone’s guess, but it will need some differenciator if it is to compete with hardware products from Google, Amazon, and Apple.

That differenciator could be the hardware itself, for instance providing a superior sound (something the HomePod is already offering) or a gamified music experience.

But it could also come in the form of exclusive or original content. After all, Amazon, Apple and Google are all using content, either video or audio, as a loss leader, an incentive to lure users to their ecosystem. Becoming the best provider of audio fictions and games along with music might be Spotify’s best edge on its hardware competitors.

External growth: Technology acquisitions

With already 13 acquisitions since 2013, Spotify has a proven track record getting its hands on companies whose technology will enrich its service. The acquisition of The Echo Nest, “a music intelligence company”, back in 2014, has been key in Spotify’s product strategy ever since, and its success today.

There is no reason for Spotify to stop what has served it so well. Based on Spotify’s ambitions, here are 4 companies that I think could take its business a step further.

Soundhound Inc.

A voice-first company building the technology layer for audio discovery, recognition and understanding.

Soundhound Inc. does a lot. From its flagship product Soundhound, a music discovery and recognition app, to Hound, a smart assistant for mobile that outperforms all its competitors, to Houndify, a voice platform for conversational intelligence, the company aims to power the coming age of audio-first interfaces.

Spotify had expressed interest in music recognition company Shazam before Apple acquired it last year. With its portfolio of apps, Soundhound Inc. provides the exact same capabilities as Shazam, and more.

This technology could be aptly applied to realize Spotify’s ambitions not just on mobile, but also on its upcoming line of hardware products.

Sofar

A niche yet global network for “secret gigs and intimate concerts.”

Sofar brings an established community of urban, early-adopting music lovers and an invaluable expertise in creating memorable moments. That it has grown largely through word-of-mouth is further proof of its merit.

Of course, Spotify is a product-driven company, not just a service provider. Getting involved in the events business may not be the most obvious choice for a tech company.

But a network such as Sofar brings with it many opportunities. Artists on Spotify could tap into Sofar’s expertise to offer premium experiences for their most engaged fans, that is, their most avid listeners on the platform.

Live events also represent massive opportunities for sponsorship and special operations with brands, something Spotify is increasingly involved in.

Smule

A maker of social music apps.

Smule is known as the developer of Sing!, a social karaoke app that boasted 52 million monthly active users in May 2017. Sing!’s appeal is twofold.

First, everything about it is social. Sing! lets you pick a song and either sing along to it as a solo or invite others for a duet or group performance. After that, you can share the result on the platform as well as other social networks.

Collaboration is strongly encouraged. Users can upvote their favorite instrumentals or covers and engage in one-on-one or group conversations using the app’s built-in messaging system.

Second, Sing! has developed an innovative approach to fan engagement and sponsored content. For the release of Disney’s Moana, fans were given the opportunity to sing a song from the movie along with The Rock. Earlier in 2017, Smule enabled its US users to audition for The Voice using the app.

Except for a “Follow” feature and a live feed of what your friends are listening, Spotify has done little to make its service truly social. Sing!’s features could help Spotify generate engagement, upsell its users to a new paid tier, and create new revenue streams through time-limited operations with content partners.

Patreon

A platform providing independent creators with the infrastructure they need to engage and monetize their community.

Patreon’s product and mission align perfectly with Spotify’s ambition to support all creators. From micropayments to reward distribution, the company has built a powerful set of tools that enable thousands of creatives worlwide to make a living off their content.

With Spotify, artists already have access to audience analytics and e-commerce integration for merchandising. Adding Patreon’s capabilities to Spotify’s range of products could help turn the company into the end-to-end platform it aims to be.

With this new mission to “unlock the potential of human creativity”, Spotify is showing the world how ambitious it really is. The truth is, it can’t afford not to be.

At a time when tech giants are eating up its streaming business, and its connection to customers is increasingly threatened by closed hardware ecosystems, experimenting is a necessity.

But Spotify will have to tread carefully. Unlike Amazon, Apple or Google, it can’t just throw billions into original content to lure customers, or start new ventures only to see where they land. For all its customer and revenue growth, it’s still burning cash by the minute — its SEC filings show an operating loss of $461 million for 2017.

Spotify isn’t short of good goals. Its success, or failure, will depend on its ability to accomplish them all without breaking the bank.