Pophouse: The Music Branding Pioneers

The $1B+ music IP investor taking a different approach to buying catalogs

Hi there! I’m Maxime, and you’re reading Recreations, a newsletter about the intersection of media, technology, and culture.

You’re receiving this either because you subscribed or because someone forwarded it to you. If you’re in the latter camp, you can subscribe here or via the button below.

I’m excited to share a piece I co-wrote with my friend Jimmy Stone, who runs a research, consulting, and investment firm called Alderbrook. You might know Jimmy as the writer of Leveling Up, Alderbrook’s authoritative newsletter, where he shares often data-packed insights on music and technology. Jimmy and I share the same love for music and the business around it and had been discussing writing something together for a while. I’m glad we got to finally do it!

Our analysis was informed by data provided by Alderbrook friends Luminate, a leading analytics platform revealing the most important trends across film, television, and music.

Today, we’re unpacking the origin story, strategy, and ambitions of Pophouse, a global entertainment and music investment firm that is taking a unique approach to the music catalog investment game.

After starting its life as a real estate and branding business, the Pophouse team and its backers made a huge financial bet (and appear to have been proven right) on their ground-breaking ABBA Voyage show. Just recently, the company made another splash, announcing it had closed a $1.3 billion music rights investment fund.

We wanted to better understand why and how this team did it. In the process, we learned a lot about where the music catalog space may be heading.

“We don’t buy catalogs to put them on a shelf and let them grow slowly … is there a brand that is not utilized or being exposed for a generation to discover?”

Pophouse CEO Per Sundin

In 1800s America, hundreds of thousands of people traveled West into unexplored territory looking for a new life. These pioneers embarked on an uncertain future and embraced risk to maximize their potential opportunities.

These days a few entrepreneurs from Sweden are carving out a new trail in the catalog investment space. Unlike many music intellectual property (“IP”) investors that seek to insulate themselves from risks, Pophouse Entertainment (“Pophouse”) is embracing innovative ideas to bring older artists’ music to new generations of fans. Along these lines, Pophouse is well known, in music circles at least, for its groundbreaking ABBA Voyage show, which has generated hundreds of millions of dollars in revenue over the past three years. More recently, in March 2025, Pophouse announced that it had closed a $1.3 billion fund to purchase music IP. But its plans appear somewhat different from the typical music rights fund.

Today, Jimmy and I are going to uncover most of what we could find on the company’s backstory, strategy, growth, risks, and future.

Meet Pophouse

What Is Pophouse’s Vision?

How is Pophouse Currently Faring?

Looking Ahead for Pophouse

It’s our pleasure to go deep with you on Pophouse!

Meet Pophouse

Pophouse is a global entertainment and music investment firm that acquires select music properties and develops them across multiple mediums and formats, with a focus on location-based and interactive entertainment.

Based in Sweden with offices in London, the company was co-founded in 2014 by Björn Ulvaeus, one of the four members of legendary Swedish pop music band ABBA, and Conni Jonsson, the founder of private equity giant EQT. Today, it’s led by CEO Per Sundin, a music industry veteran who earned his stripes at Sony Music Nordic and Universal Music, where he was instrumental to Spotify’s first deal with a label, and chaired by Lennart Blecher, EQT’s Head of Real Assets.

Pophouse’s activities consist of two main segments. On the one hand are productions, a growing range of location-based and often technology-enhanced entertainment experiences. These include:

ABBA The Museum, an interactive museum in Stockholm celebrating the legacy of ABBA

Mamma Mia! The Party, an immersive theatrical dining experience with productions currently ongoing in London, Stockholm, and Rotterdam

ABBA Voyage, a virtual concert residency in the purpose-built ABBA Arena, and developed in collaboration with all four ABBA members

Avicii Experience, an interactive museum in Stockholm dedicated to the life and work of the late Tim “Avicii” Bergling

Pippi at the Circus, a now discontinued original circus musical based on Astrid Lindgren’s kids IP that performed in Stockholm, and

An upcoming KISS avatar show, planned to launch in Las Vegas in 2027

As of March 2022, Pophouse is also a music investor, focusing on three categories of rights: publishing, master recording, and importantly, artists’ Name, Image, & Likeness, or “NIL”. Today, the company’s portfolio of rights includes (ordered by the time of their acquisition):

The master recordings and publishing rights for Swedish House Mafia’s back catalog

A 75% stake in Avicii’s master recordings and publishing

A majority share of Cyndi Lauper’s master recordings and publishing, and

The music catalog, brand, and NIL, “including the world- famous face paint designs”, of KISS

As we’ll explain throughout this piece, the production and investing components of Pophouse’s activities are not just complementary; they are indissociable. The team’s entrepreneurial savvy, as well as their branding skill and success, has convinced artists or their estates to entrust the company with their lives’ work. As Per Sundin put it in an interview, “We have a different approach to pursuing music rights deals than traditional investors. [...] There’s a parallel in private equity, when acquiring companies from founders — understanding the founder’s perspective significantly facilitates the transition.” Tellingly, while only the KISS acquisition included brand and NIL rights, the announcements for the three other deals all specified that Pophouse would be collaborating with the artists or estates on creative initiatives through dedicated joint ventures.

The Pophouse that ABBA built

It’s worth going back to Pophouse’s origins, because the initial business plan did not focus on acquiring music rights. Originally, the Pophouse project appears to have come together over a music-related… real estate investment.

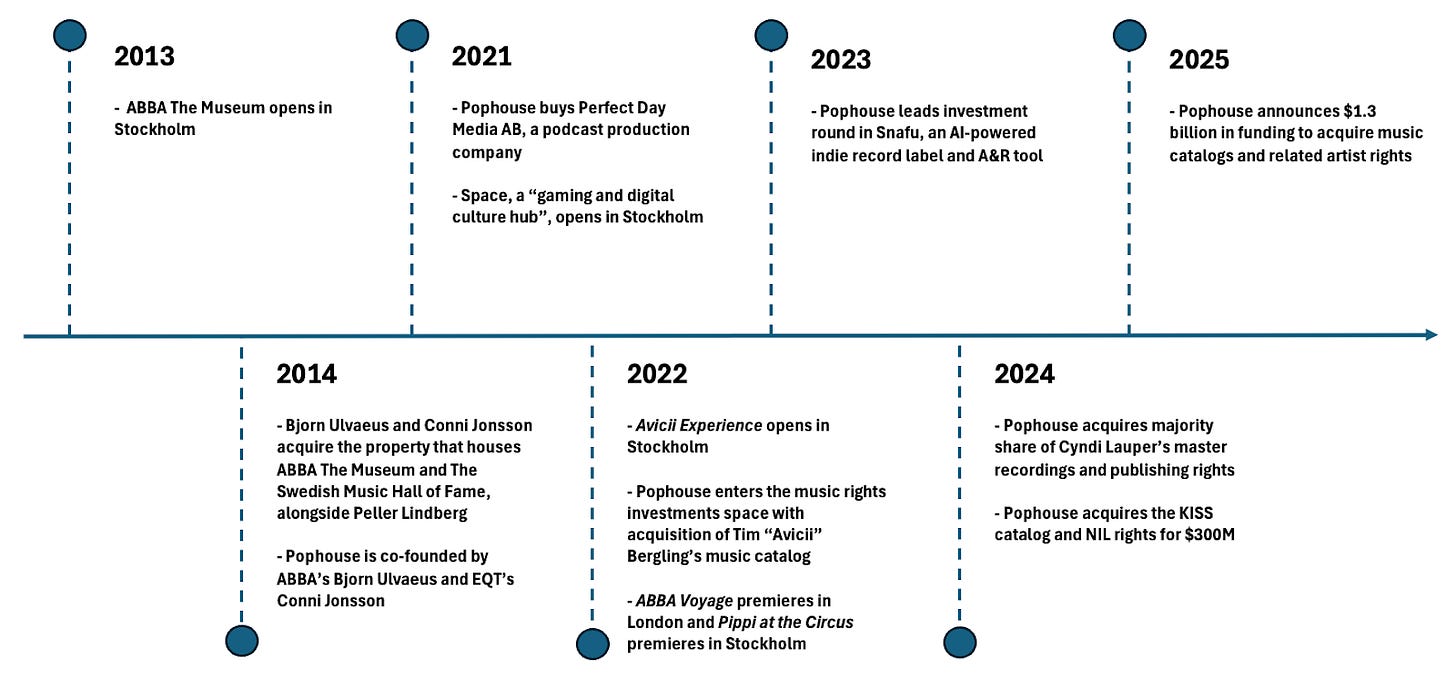

In 2014, Pophouse co-founders Björn Ulvaeus and Conni Jonsson co-acquired the property that housed ABBA The Museum and the Swedish Music Hall of Fame, alongside professional hockey player Peller Lindberg. The announcement for the deal modestly stated that the goal was “to further develop the vision of a House of Music in Stockholm.” Whether the team was just playing its cards close to its chest or the vision evolved over time, it’s fair to say that Pophouse has turned into something far more ambitious.

Pophouse’s origins were very much built around ABBA. ABBA The Museum and the dine-and-dance Mamma Mia! The Party aimed to refresh the ABBA brand for fans old and new. Throughout the years, Ulvaeus has remained involved not just as a business person but also creatively, lending his name and credibility to every one of the firm’s initiatives. He was one of the originators, and is still an executive producer, of Mamma Mia! The Party; the announcement for the 2016 opening of the Stockholm production read: “Björn Ulvaeus Invites You To Mamma Mia! The Party”. The Pippi at the Circus adaptation was another personal project of his — though ABBA colleague Benny Andersson was also involved. Only with the November 2021 opening of Space, a “gaming and digital culture hub” in Stockholm, did the company begin to diversify outside this core IP.

From ABBA Voyage To $1B+ Music IP Fund

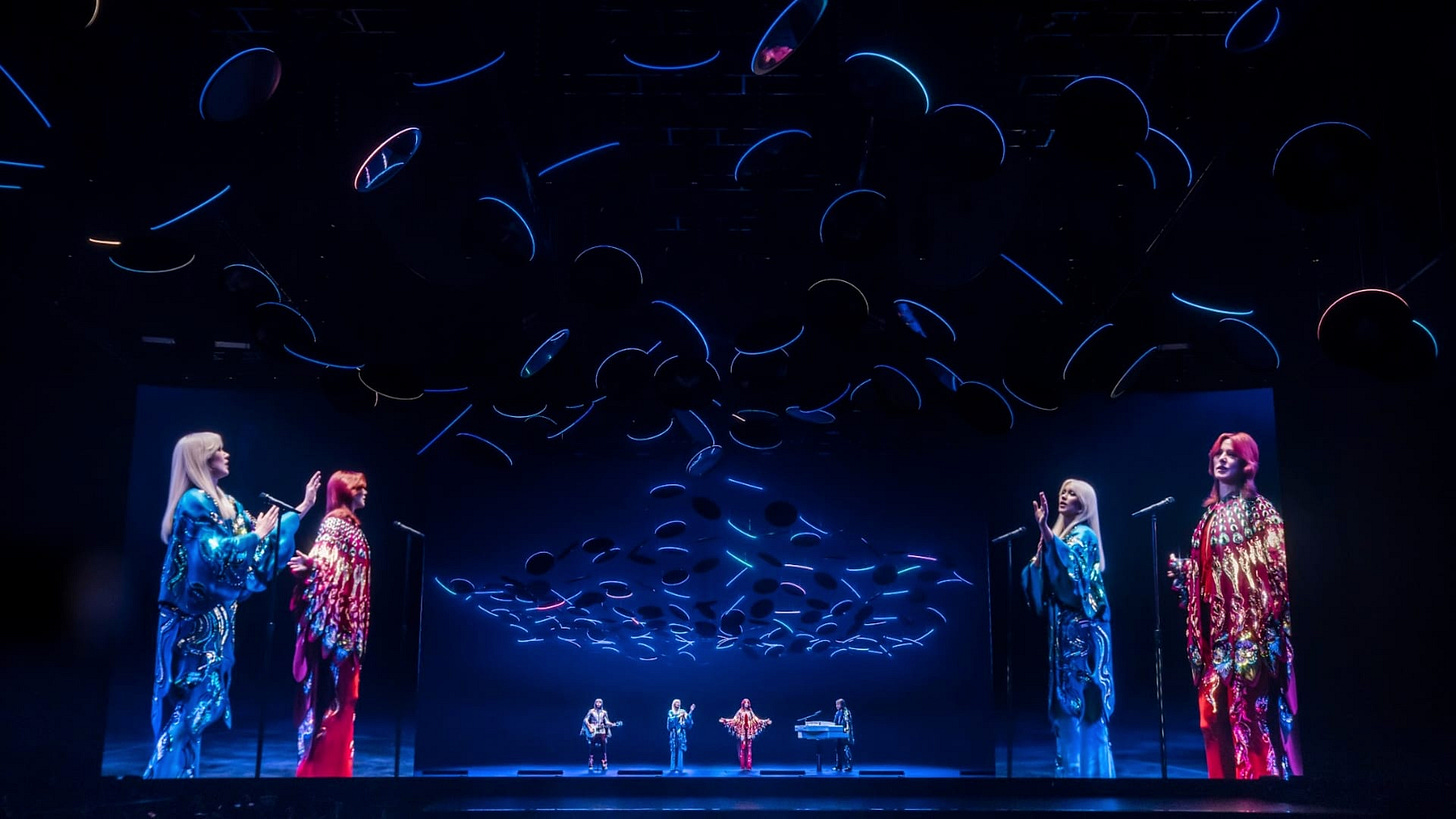

Pophouse’s development of the ABBA brand culminated in the creation of ABBA Voyage – a virtual concert residency that performs out of the ABBA Arena, a purpose-built, 3,000-seat venue located in London’s Queen Elizabeth Olympic Park. If you’re unfamiliar with ABBA Voyage, we recommend watching these two Youtube videos. One shows a short clip of the show and fans’ reactions to it. The other is a behind the scenes look at some of the technology, thought, and people that make the show happen.

The show blends live music with high-tech immersive visuals, chief among which the digital avatars, or “ABBA-tars”, created in the image of the 1979 selves of the band’s four members — Ulvaeus, Andersson, and their female counterparts Anni-Frid Lyngstad and Agnetha Fältskog. Over the course of 90 minutes, the four avatars perform a fixed “setlist of ABBA’s biggest, most popular hits – each handpicked with great care by the band.” The show premiered in May 2022 and has been running uninterrupted ever since.

One lesser-known but interesting bit of trivia about ABBA Voyage: it reportedly wasn’t always meant to be a residency. When NME reported in 2017 that ABBA was “set to return to the stage in 2019” in digital form, the article mentioned “a ‘virtual’ ABBA tour”. Technical issues, then the COVID-19 pandemic, put these plans, and the release of new music, on hold. By September 2021, the plan had seemingly changed, with the media first mentioning London’s ABBA Arena, still in the works at the time. In the process, the two new tracks that had been teased early on had also grown into a full album: Voyage, the band’s ninth and final studio album. Although one article suggested that “the arena can be broken down and transported to venues across the world”, no further tour locations have been announced so far.

As you may have guessed from the above description, ABBA Voyage was a herculean undertaking. The show took ~6 years to develop, starting in 2016 and premiering May 27th, 2022. It was developed and produced by entertainment professionals with decades of experience working with some of the biggest artists, cultural institutions, and IP. Outside help was involved, too. The band’s physical costumes were made in collaboration with Dolce & Gabbana, while the motion capture and avatar creation process were done by an army of 140 animators from Industrial Light & Magic (“ILM”), the Lucasfilm-owned visual effects pioneer.

Then, there was the arena itself, a venue equipped with state-of-the-art light, sound, and screen tech, which had to be rushed into existence once plans of a tour definitely fell out. To add even more hurdles, development was postponed temporarily by COVID. In a recent interview on the ILM podcast, one team member joked, “Someone should have said you need to stop [the project]. You just need to stop.” In the end, ABBA Voyage cost an eye-watering ~£140 million (~$188 million), one of the most expensive live music experiences in history!

As we’ll discuss in more detail shortly, it seems to all have been worth it in the end. Earlier this month, Pophouse’s Per Sundin revealed that fans “[had] purchased more than 3.3 million tickets to over 1,000 ABBA Voyage shows.” With the momentum of ABBA Voyage, Pophouse has seemingly set its sights even higher.

In March 2025, fourteen years after its inception and roughly three years after the launch of ABBA Voyage, Pophouse revealed it had successfully raised over €1 billion ($1.3 billion) for its debut fund, with an additional €200 million in follow-on capital via dedicated co-investment vehicles, bringing its total funding to over €1.2 billion ($1.3 billion). In its announcement for the deal, Pophouse described it as “one of the largest first-time private equity funds raised in Europe in the last decade”.

Although this achievement may appear obvious in hindsight, it’s anything but. Bloomberg reported that Pophouse had started its fundraising process in March 2022, months before ABBA Voyage had even premiered and certainly years before it could be deemed a blockbuster success. In other words, the show back then was “all cost, no revenue” — certainly not the selling point it is now. Of course, discussions must have gone well over time, as reality, and revenue, continued to build.

From Pophouse’s genesis to its recent fundraise, it’s been quite the ride! The below graphic compiles some of Pophouse’s key milestones over the past decade.

What Is Pophouse’s Vision?

With all the above context, let’s hit on the vision that Pophouse has for its future. In interviews, Pophouse’s CEO Per Sundin has made no secret of his plans to replicate the ABBA playbook when making new catalog investments for its fund. From the company’s website:

After investing in artists’ rights, Pophouse aims to implement a “value-add strategy” or what Pophouse co-founder Conni Jonsson describes as the “ABBA toolbox”. This consists of artist-focused experiences to reinvigorate an artist’s brand and hopefully boost their back catalog royalties. We would bucket the themes underpinning this strategy into six categories that attempt to capture the future Pophouse is building towards.

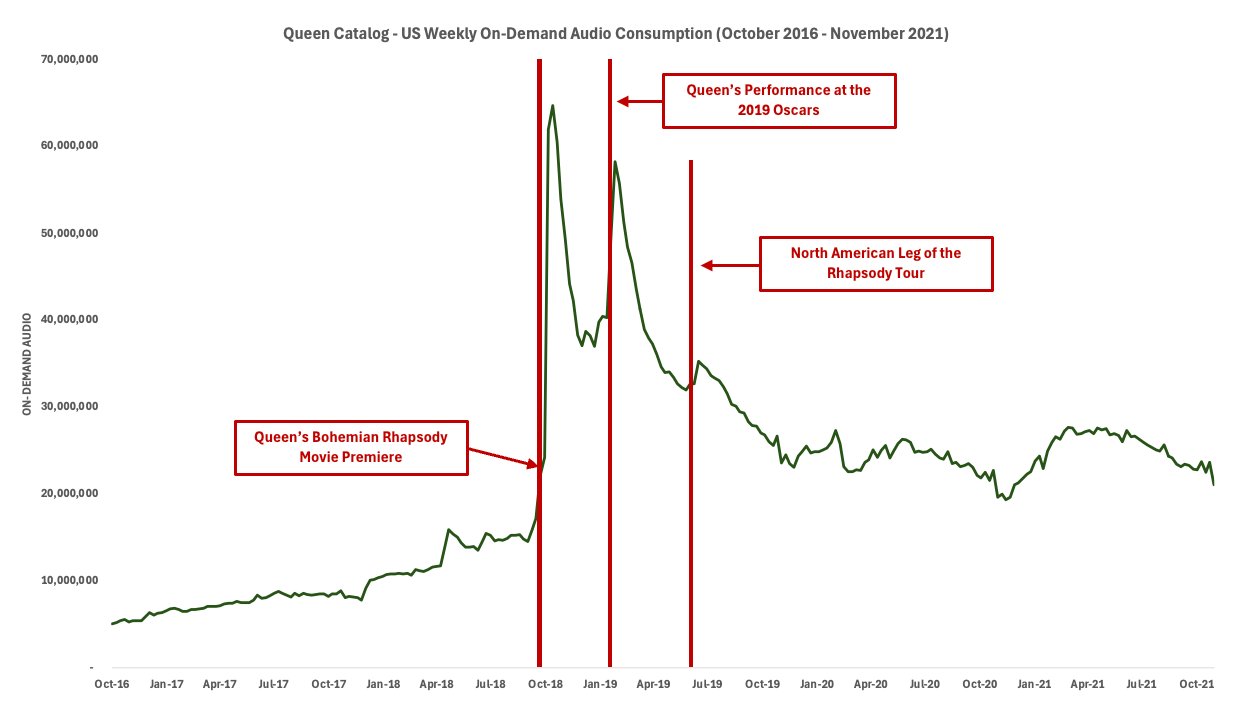

1) IP Expansion: This involves expanding an artist’s music and brand into new formats, such as interactive museums, dining experiences, biopics, avatar concerts, and more. By doing this, the goal is to expand that artist’s audience and reach. In interviews, Per Sundin has highlighted his admiration for what Disney has done with legacy IP like Marvel and Star Wars. Similarly, Sundin has pointed out how the Queen-based Bohemian Rhapsody movie led to a massive increase in demand for the band’s music. As pictured below, this is confirmed by Luminate data, which shows that Queen’s US weekly on-demand audio streams saw a ~400% spike following the release.

In short, Pophouse’s strategy is acutely focused on the need to not just engage existing fans, but also to seek out and onboard new ones. For example, ABBA Voyage offers 16-25 year olds tickets for the Dance Floor area, which is described as “perfect to meet up with friends and dance the night away.” Given Pophouse’s focus on iconic (i.e., older) catalogs, finding these kinds of opportunities will be crucial.

2) Narrative Due Diligence: When exploring potential catalog acquisitions, music rights investors will typically run thorough financial and legal due diligence processes. They will consider everything from streaming consumption to the geographic distribution of an artist’s audience. Numbers like these help paint a picture of the upside that might be unlocked through more active administration. Meanwhile, Pophouse’s focus on NIL rights calls for different, more culturally savvy insight, something Sundin has defined in interviews as “brand and narrative due diligence — understanding the music, the catalog, and the lyrics of the songwriter. Is there a story about the artist? Could there be a documentary, a biopic, a TV series, or a musical?” This research might end up informing not just the medium but also the format and content of a product. It can also provide a blueprint for long-term franchise development. In the same way that the plot of Mamma Mia! was shaped by ABBA’s songs, it gave the dine & dance show Mamma Mia! The Party its Greek theme. Digging deep into an artist’s lore can surface myriads of throughlines or Easter eggs that are sure to excite the most loyal and perceptive of fans. As it happens, Pophouse makes good use of their input. Here’s Sundin again:

“With KISS, there are fans that have been fans for 50 years. We did deep research and collected 10 people into a superfan panel and invited them to Vegas [in mid-March]. In workshops, we asked them what they would expect, what they liked and didn’t like because we respect them. That doesn’t mean we will do everything they say. We will adapt their feedback for the next 50 years.”

By engaging with superfans early on, Pophouse is not only collecting valuable feedback, but also tapping into the best and most influential ambassadors for whenever its next offering is ready to launch.

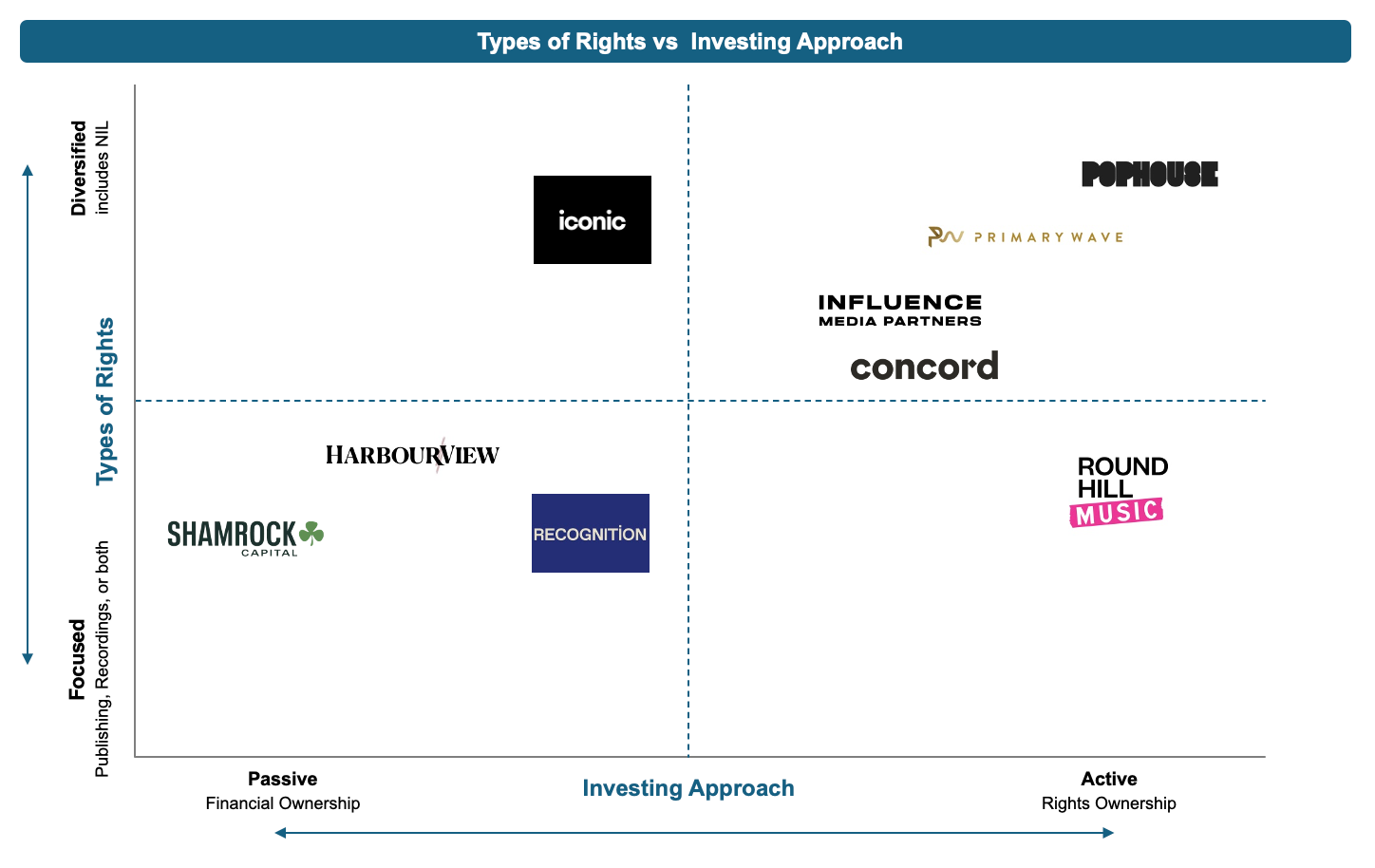

3) NIL Rights: Music IP investors that deploy an active management strategy typically look to unlock upside via improved administration, which involves activities like renegotiating administration agreements and enhancing monitoring capabilities. Investors may also pursue synchronization opportunities or organize workshops to let artists give older musical works new cultural relevance. Pophouse will likely follow the same playbook as it delivers its promise to investors. What sets the company apart from many of its peers is its interest in Name, Image, and Likeness rights. Whereas music IP investors traditionally focus on masters rights, publishing rights, or a combination of both, Pophouse’s more diversified range of rights enables it to create value off an artist’s name in ways that other music investors can’t.

4) Concentrated Bets: Another one of Pophouse’s differentiators is its concentrated approach to rights acquisitions. Per Sundin has said in interviews that Pophouse plans to acquire eight to ten catalogs in its fund. As mentioned, in April 2025, it was also reported that Pophouse had “already deployed 30% of its fund through four deals with artists such as KISS, Cyndi Lauper, and Swedish electronic dance music icons Avicii and Swedish House Mafia.”

There are a few observations to make from this. First, this is a lower number of deals than what we’ve seen from any similarly-sized music IP fund. Second, the remaining 4 to 6 deals will likely be significant ones. If we assume that Pophouse will add leverage at a 30% to 50% loan-to-value ratio to its total $1.3 billion of equity commitments, that’s $1.9 to $2.6 billion of total buying capacity.

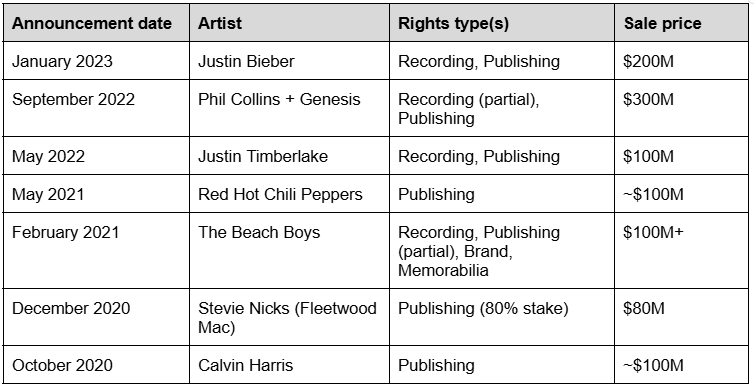

With $900 million of equity left — the remaining 70% of its funding round — and depending on the amount of borrowing capacity and the number of future deals pursued, we estimate that the team likely has an average of $200 million to $450 million to spend on each individual deal. For context, below is a list of a few recent catalog sales in that price range. While only the Beach Boys sale included the sort of brand rights that Pophouse is after, it’s clear that a $200+ million check size could go a long way, and enable the team to court superstar artists.

5) Multidisciplinary Team Experience: The varied nature of Pophouse’s strategy requires the company to draw talent from outside of just music. ABBA Voyage is a prime example of this. From real estate and construction (e.g., the specifically-built ABBA Arena) to technology (e.g., motion capture, immersive light and sound systems) to consumer products (e.g., merch), this single experience took the combined effort of hundreds of people across dozens of trades.

6) Experimenting With Technology: Like the rest of the industry, music rights investors have the difficult task of monitoring technological change and understanding the ways it might impact their portfolios’ for better or worse. Pophouse appears aptly suited for the task. As mentioned, Ulvaeus himself has extensive experience with technology as both a startup investor and the president of CISAC, where he deals with disruption on a daily basis. Pophouse’s relationship with EQT, an experienced investor, also brings a direct connection to the technology world. This know-how is manifest in the type of experiences that Pophouse has developed so far. The Avicii Experience includes a “VR karaoke” and a wrap-around DJ booth meant to mimic the live experience from the artist’s perspective. Of course, no project so far embodies that trait better than ABBA Voyage, with its high-tech screen and light show. Embracing technology is especially key to engaging with younger fans. In that respect, the bar may be higher for Pophouse than for any of its peers. Indeed, other music rights investors only have to bring their music to wherever “the kids” are going online, whether that’s social platforms or gaming. Put differently, theirs is a distribution problem. On the other hand, Pophouse’s success rests on its ability to draw fans to its physical locations — a much bigger ask for digital-first generations.

In more ways than one, Pophouse is blazing a trail for how music catalog investors test the limits of what’s possible for older catalogs. The key question is: “Can Pophouse deliver on its plans?” While this will take years to answer, we can look at how things are going so far.

How is Pophouse Currently Faring?

Pophouse’s plans for the future look exciting. But to ground this analysis, let’s review how the company is performing by analyzing the performance of some key aspects of its strategy, namely:

Projects in the “ABBA Toolbox”

ABBA’s back catalog

Other parts of Pophouse’s ecosystem

#1: Performance of Pophouse’s “ABBA Toolbox” Strategy

As mentioned above, Pophouse has worked on several projects with ABBA to keep their brand and music alive for existing and new generations of fans. Among the various “tools” that Pophouse has developed for ABBA, ABBA Voyage is its most ambitious, expensive, and financially successful bet so far.

Despite various challenges, the show has been a success from a cultural and financial perspective. Reviews have been very favorable. The show has played 7 times per week for the past three-plus years to, on average, a nearly sold-out audience. Here’s one ABBA fan’s reaction:

“There is an emotional connection between the audience and the screen…It’s such an immersive experience. Here’s your favourite band, playing your favourite songs and you’re in the room dancing like no one’s watching. I’ve been to so many gigs in my life and I can’t describe any other that made me feel like this.”

Meanwhile, the financial results have been impressive for a novel concert experience from a band who hasn’t performed live in ~40 years. According to Pophouse CEO Per Sundin, ABBA Voyage needed 3 million people to buy tickets for the show to break even. As of May 2025, over 3.3 million people have reportedly bought tickets, meaning the show has broken even in just under three years.

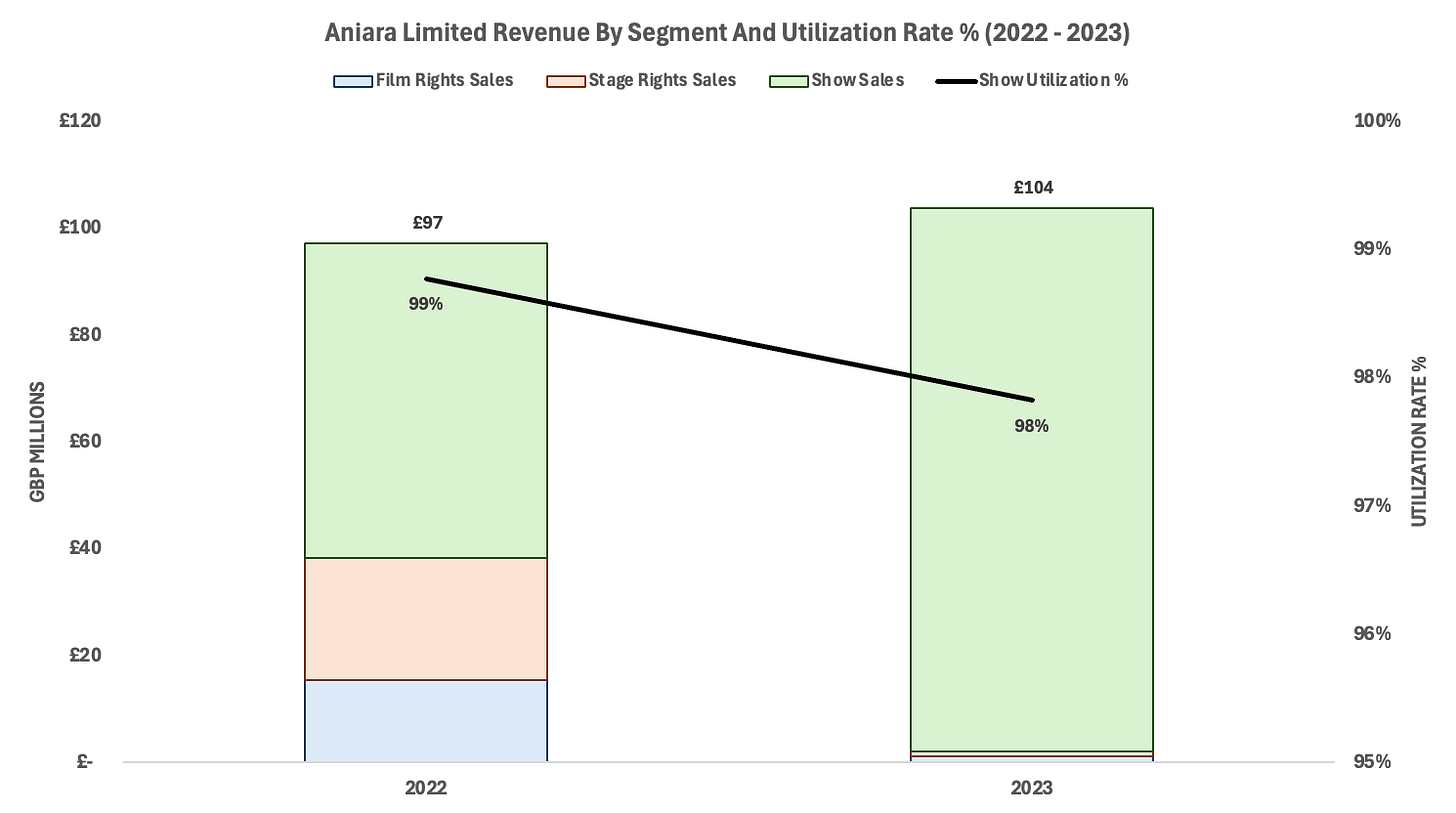

Aniara Limited, the entity responsible for managing ABBA Voyage and ABBA Arena, has publicly reported financial results through 2023. However, we had some trouble figuring out why the company’s cost of sales were so high in the financial statements, we take our analysis of Aniara’s profit with a grain of salt!

Regardless, the key drivers of ABBA Voyage’s financial results to date include:

ABBA Voyage averaged more than one show per day through 2023.

Almost every show was sold out (98%+ utilized per show) through 2023.

The average revenue per ticket sold actually grew in 2023 to £92.50 (~$124).

The project generated ~98% of its revenue from the show in 2023, with ~2% from film rights and stage rights.

The reported breakeven analysis suggests that the show’s profit margin is ~50%. (Again though, the financials are somewhat confusing relative to management’s commentary.)

Finally, ABBA Voyage has reportedly made a significant economic impact on London’s economy, generating £1.4 billion in related sales between 2022 and 2024.

With the show reaching 3.3 million visitors as of May 2025, our math suggests that the above trends were likely similar in 2024 and early 2025. And given that number of paying attendees multiplied by an average revenue per ticket of ~£90, we estimate that ABBA Voyage has generated roughly £300 million (~$400 million) to date!

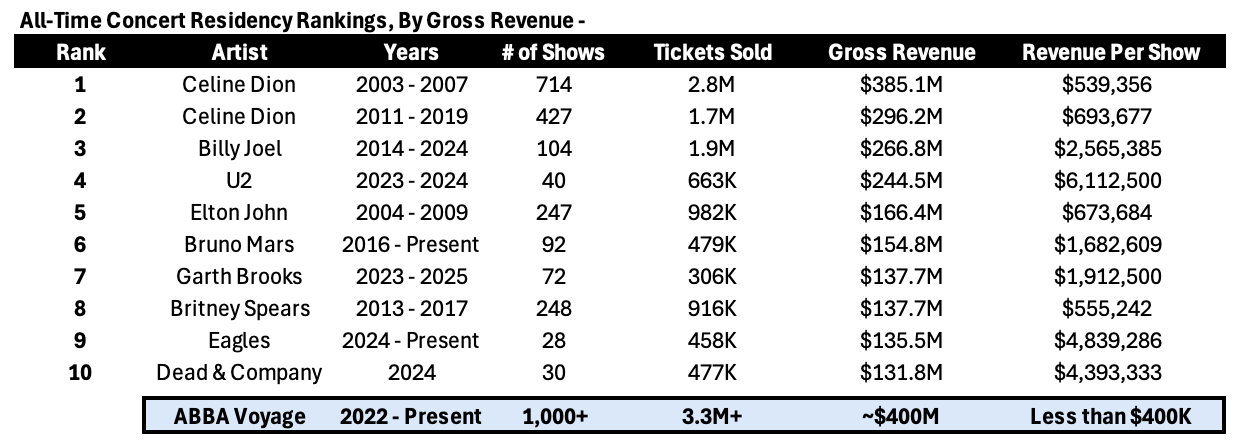

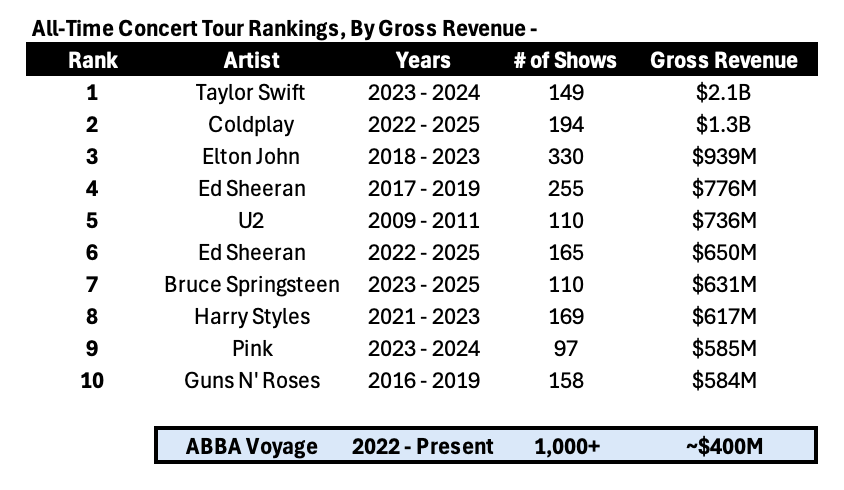

It is worth noting how successful ABBA Voyage has been relative to other artist residencies and concert tours. For context, Aniara’s financial results suggest that ABBA Voyage has already outperformed every other concert residency in history 🤯. One of the primary drivers for this is ABBA Voyage’s virtual artists enabling significantly more shows compared to other residencies over the course of a year. Along these lines, ABBA Voyage’s revenue per show is well below other top concert residencies.

Meanwhile, ABBA Voyage ranks just outside the top 20 highest grossing concert tours of all-time.

From my perspective, these comparisons highlight how Pophouse and the project’s other investors made a gutsy bet. In order to recoup their investment, they needed to believe that ABBA Voyage would be one of the top selling concert experiences of all-time. The finance nerd in me is curious to know how this investor group structured their ~£140 million investment in ABBA Voyage. Was it all equity? Were they able to borrow a portion of the amount secured against assets? (We aren’t real estate experts but ABBA Arena is likely a valuable asset that can be used as collateral for a loan. Aniara’s financials suggest ~£40 million was owed to “other creditors” in 2022). Regardless, in sports terms, Pophouse stepped up to the plate, called their home run shot, and then hit the ball out of the ballpark.

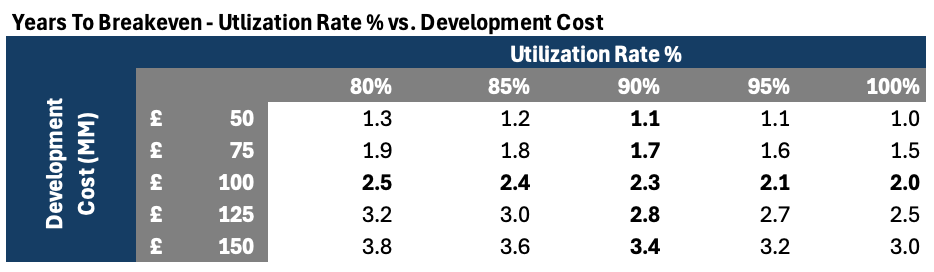

Given all of the above context, it is fair to ask if Pophouse or someone else can reproduce the financial success of ABBA Voyage with other artists. One thing that will hopefully help is lowering the cost to develop a similar-type of avatar show. For example, we estimate that the time to breakeven for a comparable project can be reduced by ~1 year for each £50 million reduction in development costs.

Another potential mitigant for the large development cost could be a public-private partnership, where Pophouse works with a local government to finance an experience in hopes of replicating ABBA Voyage’s positive economic impact in London.

Either way, Pophouse has blown through ABBA Voyage’s breakeven goal and is attracting other successful artists who want to apply the “ABBA toolbox” to their brands and music catalogs. For instance, as mentioned earlier, Pophouse recently acquired the band KISS’s music catalog and NIL rights for $300 million.

As part of the acquisition announcement, Pophouse teased plans for a KISS biopic, experience, and avatar show. Since the novelty of an avatar concert experience can’t go on forever, longevity will likely be determined by tapping into aspects of a given artist’s connection with their unique fanbase. Along these lines, it will be interesting to see what learnings from ABBA Voyage are incorporated into the KISS avatar show, as well as how Pophouse adapts the experience to a different type of audience.

#2: Performance of ABBA’s Catalog

As previously mentioned, a key strategic rationale for producing groundbreaking experiences, like ABBA Voyage, is to increase the value of an artist’s music catalog and associated IP. It’s not just about the production being innovative and profitable on its own. From a financial standpoint, it’s arguably more valuable to reengage existing fans and introduce the music to new generations of fans.

To that end, it’s worth noting that Pophouse developed its “ABBA Toolbox” without owning the band’s music and NIL rights. Based on our research, these rights appear to be owned by Universal Music Group (“UMG”) and ABBA’s band members. That said, there is still overlap between ABBA’s rightsholders and ABBA Voyage. For example, as mentioned above, Pophouse co-founder Bjorn Ulvaeus is a member of ABBA. Meanwhile, UMG invested in ABBA Voyage.

Regardless, this is a slightly different approach than Pophouse’s new music IP fund — discussed in the next section — which will buy music and NIL rights and then seek to develop thoughtful productions related to the acquired music and artist IP. It seems like Pophouse wanted to build out its platform and operational capabilities before raising an investment fund. Driving successful outcomes first should help Pophouse win future catalog deals and enable the team to better underwrite risk. It’s also a powerful marketing tool for raising capital to be able to show to potential limited partners that the Pophouse platform has the capabilities to drive value.

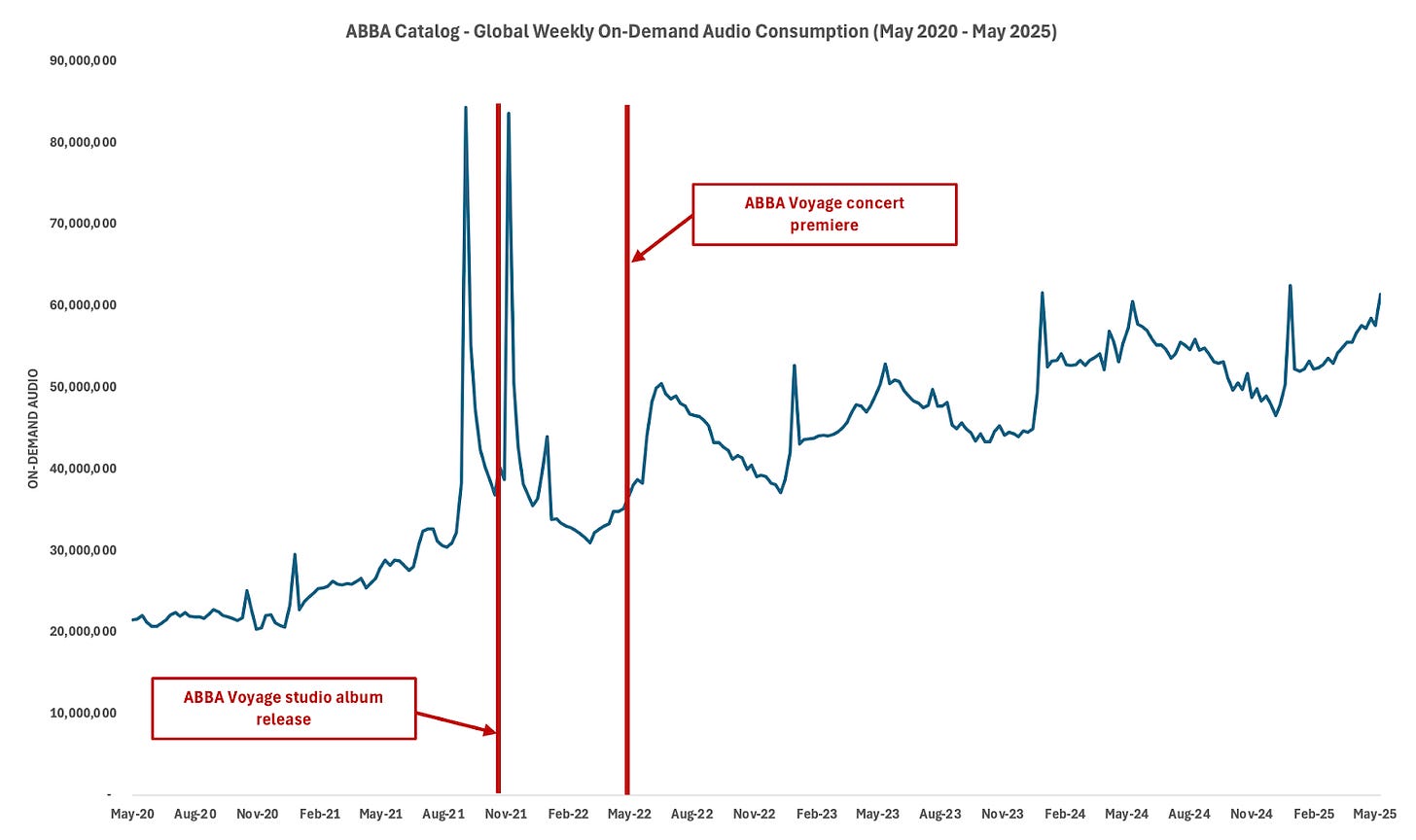

The data suggests that Pophouse’s strategy has worked extremely well for ABBA’s music rightsholders. According to Luminate data, ABBA’s catalog has seen its global weekly on-demand audio streams increase ~3x from May 2020 to May 2025! In other words, ABBA Voyage’s success appears to have produced a positive halo effect for ABBA’s music catalog.

Whereas many artist events — like a new album release, biopic (e.g., Queen’s Bohemian Rhapsody discussed above), or high-profile synchronization placement — will create a shark fin shape in the consumption data (i.e., consumption spikes and then gradually or quickly declines before hopefully leveling off at a higher baseline), ABBA Voyage’s ongoing run appears to be contributing to the band’s catalog experiencing sustained growth over the past three years.

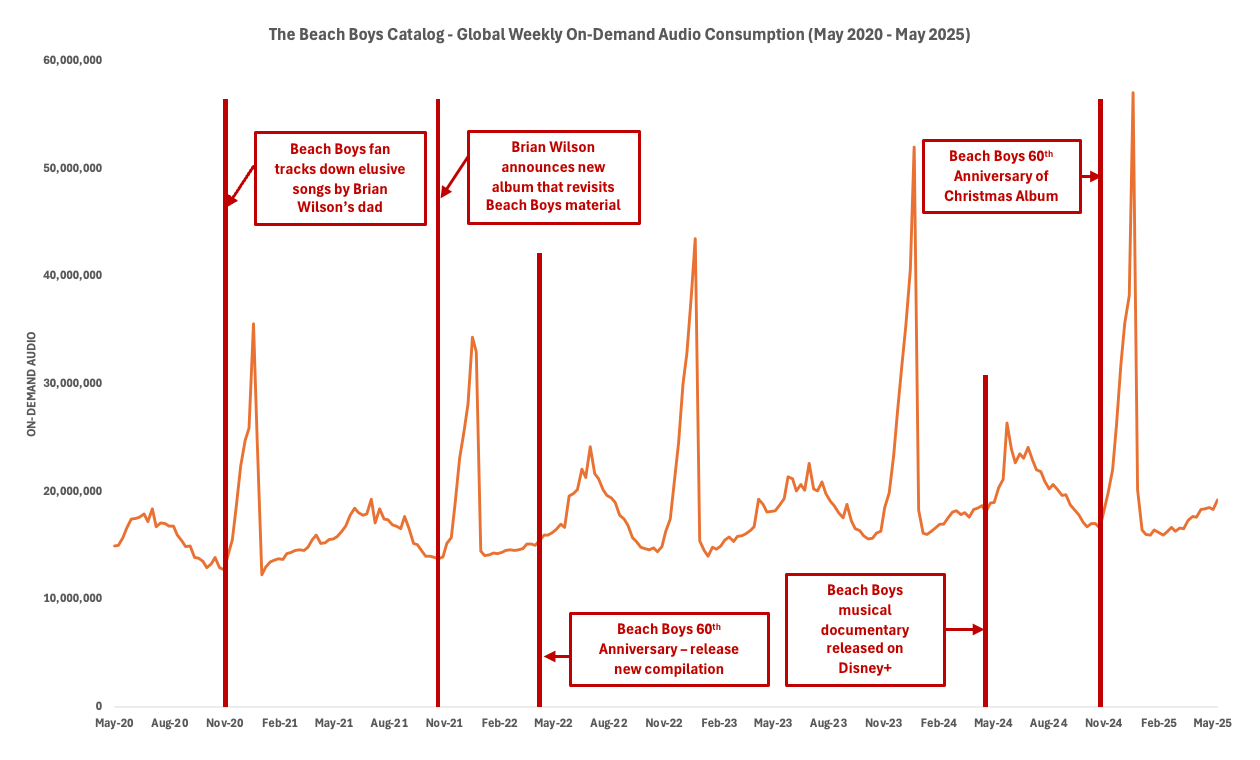

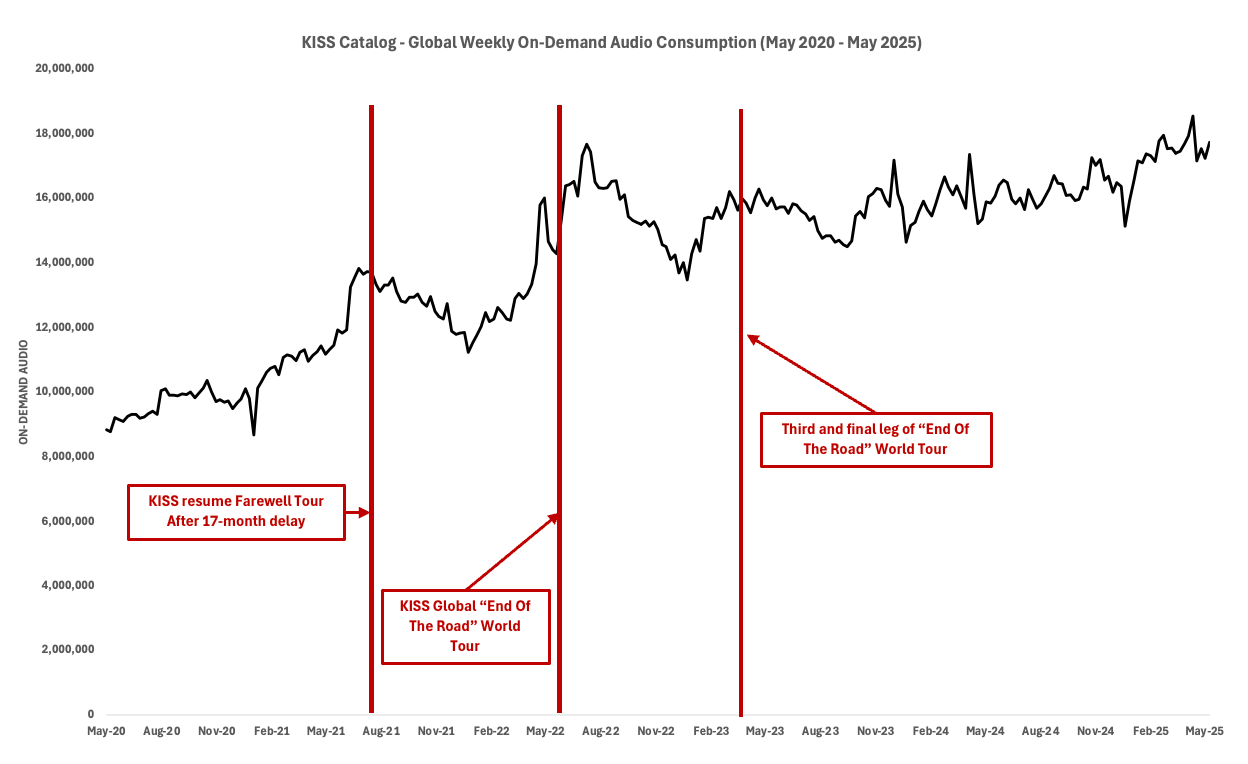

For context, let’s look at two other legacy catalogs: The Beach Boys, and KISS.

The Beach Boys music and NIL rights were acquired by music IP investor Iconic Artists Group in 2021. According to Luminate data, the catalog has seen short-term spikes in consumption during specific events over the past 5 years. However, the catalog’s baseline growth has only increased modestly.

Conversely, Pophouse’s recently acquired KISS catalog has grown consistently over the same time period — albeit not as fast as ABBA’s catalog. It’s worth noting that KISS was pursuing several legs of their final world tour. Pophouse will presumably look to continue this strong momentum with the eventual release of the KISS avatar concert.

Simply put, Pophouse will seek to energize legacy catalogs that it acquires in a similar fashion to what it’s done with ABBA.

#3: Other Parts of Pophouse’s Ecosystem

As discussed above, Pophouse’s ecosystem extends beyond projects with ABBA. While details about these projects are scant, we can get a rough idea through publicly available sources. From our perspective, Pophouse’s other platform projects can be broken down into three buckets:

1) Music Catalog Investments – Pophouse’s catalog investment activity appears to be going very well. As discussed above, in March 2025, the company announced it had closed a $1.3 billion music rights fund, and it has already deployed 30% of the fund.

2) Music-Related Productions – Pophouse’s music-related productions seem to have done reasonably well, although at a much smaller scale than its ABBA Voyage project. Pophouse worked with electronic artist Avicii’s estate to launch an interactive tribute museum located in Stockholm in February 2022. The Avicii Experience museum has received good reviews, with fans of the artist calling it “nothing short of amazing”. On the other hand, Pippi at the Circus received some favorable reviews but closed in 2023.

3) Other Investments — Pophouse has also made some real estate and venture investments, which appear to have performed less favorably. Pophouse created a multi-purpose venue in Stockholm called Space. Covering 5,000 square meters of customized entertainment experiences across three levels, it included a video gaming center, a multi-purpose arena, content creation studios, restaurants, and cafes. According to Google and Linkedin, the venue permanently closed in 2024. Pophouse has also made several early-stage investments in Sweden-based Snafu, an AI-enabled record label and A&R tool. It is difficult to know how well this particular investment is performing because the company is private. That said, Linkedin shows the company’s headcount has declined ~33% over the past two years, suggesting that growth may not have materialized as envisioned.

In summary, Pophouse’s investment results appear a bit more mixed than its ABBA Voyage experience. That’s not too surprising, as many of Pophouse’s bets have been at an earlier stage, which typically means higher risk. Regardless, investors felt good enough about the Pophouse team’s track record to support its inaugural music rights fund.

Looking Ahead for Pophouse

Given what we now know, let’s consider three questions about Pophouse’s future:

What are the unique benefits of Pophouse’s strategic approach going forward?

What risks does Pophouse face?

What characteristics will Pophouse look for in future catalog investments?

What are the benefits of Pophouse’s strategic approach?

One of the things that makes the catalog investment game difficult for investors is that most don’t have very deep moats. What are competitive moats? In his book 7 Powers, Hamilton Helmer defines them as “those barriers that protect your business’ margins from the erosive forces of competition.” Dumbing this down, a deep moat means it’s harder and less likely that competitors will show up and take your profit.

Another key aspect of moats is that a business is best positioned to create the foundations of a long-term sustainable moat while there is greater uncertainty. As soon as product market fit is obvious and a business is having success, competitors are much more likely to copy that insight. Packy McCormick summarizes it well: “The more obvious your idea is and the easier it is to build, the faster you need to dig moats. Conversely, the less obvious your idea is and the harder it is to build, the longer you have to dig moats.”

Let’s apply these concepts to music catalog investing. If we were to rewind back to 10 years ago, the consensus view on Wall Street was that music IP was a “risky asset class”. That perspective made a good deal of sense at the time. The recorded music industry had been shrinking for ~15 years after piracy gutted industry revenues. In the early- to mid-2010s, there were a small number of music IP investors as well as the traditional labels and publishers to buy music catalogs.

Then Spotify and music streaming came along and changed everything. Industry revenues surged. The consensus view of music IP shifted to a consistent, non-cyclical asset. Earlier entrants — like Primary Wave and Round Hill Music — were able to realize strong returns. As a result, more funds have raised capital to enter the space. Bigger funds have been raised. Simply put, nowadays, there is hardly any uncertainty about music IP as an “asset class”.

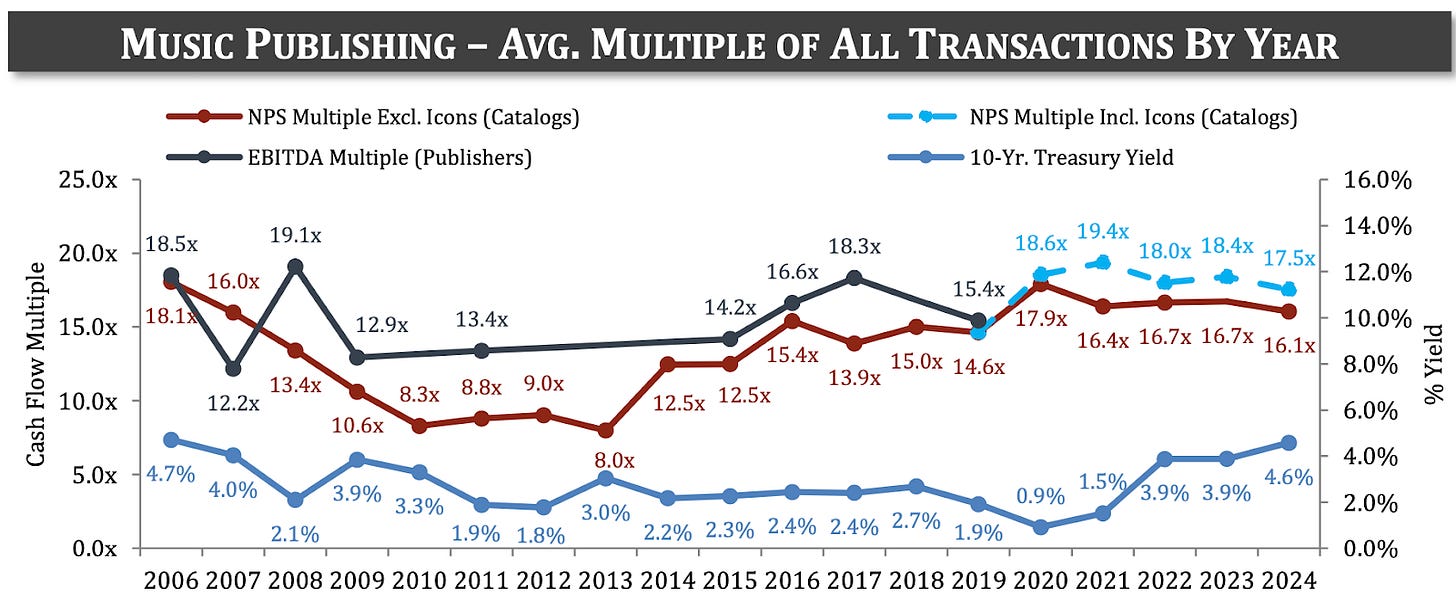

This trend has been a very good thing for artists and songwriters looking to sell some or all of their music catalog. The chart below from Shot Tower Capital shows how much multiples have increased over the past 15 years. With prices rising, investor return expectations have been declining in many cases. And there is a smaller margin of error when making new investments. In the current environment, moats are more important than ever for music IP investors trying to differentiate and generate solid returns.

We’d categorize the ways most music IP investors look to differentiate into 1) active management approach; 2) cost of capital; 3) investment size; 4) right type focus; 5) genre focus; 6) geographic focus; and 7) catalog age focus. Of these seven buckets, we’d argue that number 1 — active management approach — is the only one capable of creating a deep moat. This is because we believe that operational capability is much harder to replicate than the other six, particularly number 2 (cost of capital).

And this is one of the primary reasons that Pophouse’s strategy is exciting. The company appears to be digging a pretty deep moat right now via its “ABBA Toolbox”. Yes, unlike many other music IP investors, Pophouse wants to acquire artist’s NIL rights in addition to their recorded music and publishing rights. But it’s the other artist-related productions, especially the avatar concerts, that will be difficult for competitors to copy. Again, ABBA Voyage took 5+ years to complete, required some of the best branding and visual effects talent in the world, and cost $185+ million. Maybe it will be easier for competitors to fast follow Pophouse, but these types of productions still don’t feel like easy things to reproduce. The avatar concerts and other catalog-related productions have other strategic benefits, including:

Attracting other top artists — like KISS and Cyndi Lauper — who want to see their legacies treated in a similarly unique fashion;

Attracting investors who want to participate in Pophouse’s differentiated strategy; and

Enabling Pophouse to pay more for investments given their ability to increase catalog cash flows in the future.

Pophouse CEO Per Sundin has said that an avatar concert will not be a fit for every one of its catalog acquisitions. Coming up with creative productions that aren’t as technically difficult and expensive makes sense on several levels. We expect that Pophouse will continue experimenting with innovative artist projects, some of which will focus on quicker wins.

Still, for the strategic reasons outlined above, we’d argue that avatar concerts should be a key lens through which to evaluate potential acquisitions. Our sense is that the music IP investment market is still catching up and on to the multi-faceted success of ABBA Voyage. Now feels like the time for Pophouse to lean in and continue digging an even deeper moat.

What risks does Pophouse face?

To be clear, the long-term success of Pophouse’s strategy is still uncertain. It’s unclear if they can produce similarly impressive results with future avatar concerts as ABBA Voyage. Similarly, it’s not guaranteed that they will deliver their fund investors attractive returns. Some of the key risks facing Pophouse’s music catalog fund include:

IP Management Risk: In theory, rights holders have every incentive to make their properties as ubiquitous as possible. After all, more visibility means more opportunities for engagement and monetization. But in reality, they have the difficult task to strike a balance between proliferation and scarcity. If Pophouse hopes to not only preserve but grow the value of its own IP, it will need to tread carefully. The viability of ABBA Voyage for example rests in large part on the show’s scarcity, which ensures that demand is “sufficiently underserved”. If Pophouse could debut an exact copy somewhere else overnight — an unlikely event considering the show’s special requirements — it’s unclear if current consumer demand would be enough to sustain multiple venues operating at once. Instead, a second venue may end up cannibalizing the first one, leading to lackluster attendance, and revenue, at both.

Team Risk: Pophouse has been able to attract and partner with top technical, investment, and creative talent. However, will the company be able to retain its existing employees and partners as well as attract new ones that are necessary to continue scaling its platform?

Diversification Risk. Pophouse wants to buy 8-10 catalogs in its fund. This means it intends to build a more concentrated investment portfolio relative to other music catalog funds. As a result, there is a smaller margin of error if it miscalculates the future of any one catalog in its portfolio.

Underwriting Risk. This is related to the previous point. Pophouse’s work with ABBA appears to have been a win/win. However, will this success continue, especially in a scenario where a Pophouse production doesn’t live up to expectations or broader market growth slows?

Competitor Risk. There are a couple other music IP investors (e.g., Primary Wave, Iconic Artists Group) that have focused on acquiring rights — including NIL rights — from legacy music artists. It remains to be seen if any of Pophouse’s competitors seek to enter the virtual concert residency space.

Technology Risk. According to Pophouse, it will take 3-5 years to launch an ABBA Voyage type experience for another artist. Could a technological advancement enable a shorter lead time for competitors? Will new technology emerge that produces a better experience than what Pophouse currently uses?

In summary, we think Pophouse is uniquely positioned in the catalog investment market. Of course, their future success isn’t guaranteed and there are several hurdles that must be overcome in order to realize the team’s vision.

What will Pophouse look for in future catalog investments?

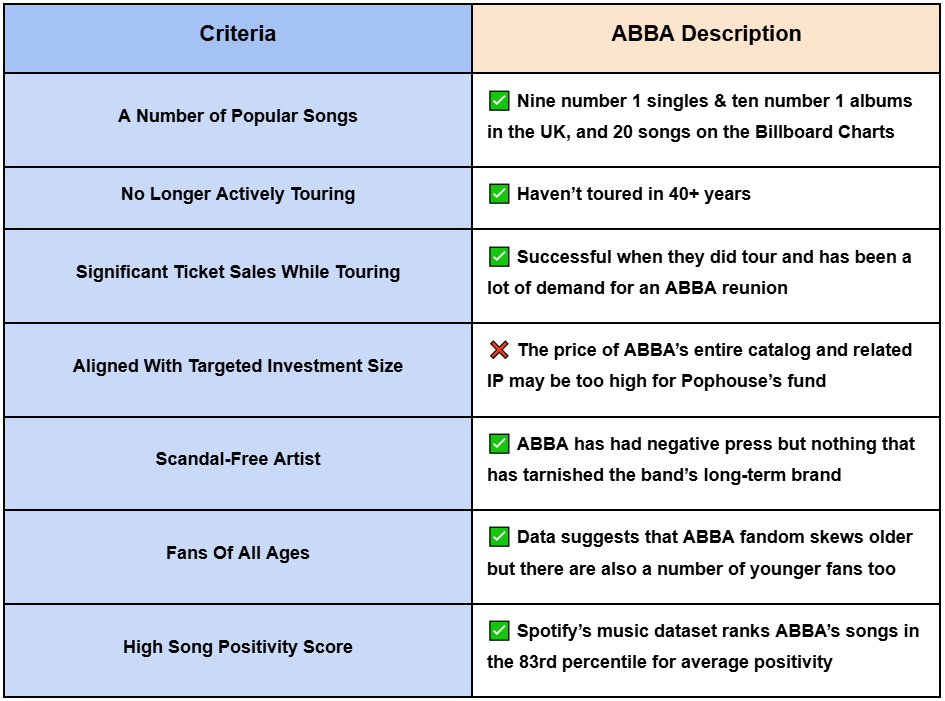

Before wrapping up, we thought it would be fun to speculate on catalogs that may be prime acquisition candidates for Pophouse. To do so, we developed the below framework of 7 criteria to guide our search and applied it to ABBA, based on our research for this article. Note that some of Pophouse’s catalogs (e.g., Swedish House Mafia) don’t check every criteria on our list, but we’d still expect catalogs, particularly those that have avatar concerts, to check most of them.

With the above framework in mind (and ignoring any artists’ interest in actually selling their rights in the near future), we made a speculative Pophouse acquisition list. Also, once we did a tiny bit of digging, we realized that it’s harder than you might think to find successful legacy artists, who haven’t already sold a portion of their music rights in the past 5-10 years. Anyway, our top 11 list includes, in no particular order: Madonna, Led Zeppelin, Tom Petty, Jimmy Buffett, Guns N’ Roses, Van Halen, The Allman Brothers Band, George Michael / Wham!, Black Eyed Peas, James Brown (in partnership with Primary Wave because we selfishly want to see this avatar concert happen 🤞), and The Beatles (of course).

Which ones on our list did we get wrong and which ones would you add? Drop us a note!

Closing Thoughts

What Pophouse wants to build is ambitious and will require blazing a new trail. Pophouse has certainly had one mega success with ABBA Voyage, a project that went a long way in enabling the firm to raise a significant music IP fund.

As we’ve discussed, developing large-scale innovative projects like ABBA Voyage requires a great deal of effort and a healthy dose of luck. So the jury remains out on if Pophouse’s approach can drive a similar degree of value creation again and again.

Regardless, in a success case, the ultimate goal — to combine music rights with branding and creative opportunities to maximize artistic and financial potential — can be a win/win/win for artists, fans, and investors.

In summary then, to ultimately understand Pophouse’s impact, we’ll have to wait and see how things evolve over the next several years. That said, we wouldn’t be surprised if Pophouse continues to rewrite the rules for an artist’s longevity. Eventually, their vision could be adopted by both music catalog investors and the Major labels, looking to expand their proven IP across new experiences to reengage existing fans and to attract new generations. This is particularly important now, as the Majors seek to find new drivers of revenue growth.

The band KISS sums it up well in their new Pophouse avatar concert trailer video: “The future is so exciting. We can live on eternally.”

Pretty wild stuff for what appears to have started as a boring real estate investment!

Thank you for reading. If you’ve enjoyed this essay, please consider giving it a like and take a minute to share it with others. It really helps.

As always, I’d love to hear your thoughts! You can find me on Linkedin or on X, or just reply directly to this email.

Very interesting, many thanks for the whole work

Very well written detailed piece. Thank you