The new spectrum of music shows

Sonorium, Cercle, and Fever are reinventing how concerts look and feel

Hi there! I’m Maxime, and you’re reading Recreations, a newsletter about the intersection of media, technology, and culture.

You’re receiving this either because you subscribed or because someone forwarded it to you. If you’re in the latter camp, you can subscribe here or via the button below.

Setting the stage

While Taylor Swift, Beyoncé, and Billie Eilish have made headlines with their sold-out global tours, live music is in a state of quiet crisis: for every blockbuster exception, there are thousands of artists facing half-empty venues. In May 2024 alone, both The Black Keys and Jennifer Lopez — two acts previously thought to be guaranteed stadium-fillers — canceled their upcoming North American tours due to weak ticket sales.

Part of this slump can be attributed to market corrections after the post-lockdown boom. Skyrocketing ticket prices are also starting to alienate fans: at $120 in June 2025, the average ticket price for a top 100 tour may be down 6% from last year but is still up nearly 70% from 2010. The surge was especially sharp in recent years: Pollstar reports an overall 27.4% increase from 2019 to 2023. And then, there’s the matter of oversupply. With artists big and small racing to make up for pandemic losses, the market has reached saturation, forcing fans to choose more selectively.

But beneath these economic tremors lies a deeper cultural shift: audiences are increasingly craving concerts that feel intimate and emotionally charged. Eventbrite’s 2025 TRNDS report found that 64% of event organizers expect demand for niche events to grow this year, with attendance at so-called micro-events up 23% last year across major metros. Among Gen Z respondents, nearly 40% favor immersive, intimate music experiences.

These events may not draw stadium headlines, but they have numerous benefits. Unburdened by the huge overheads of arena and stadium tours, organizers can experiment with unexpected venues, original formats, and deeper artist-fan connections. Meanwhile, a carefully crafted sense of exclusivity allows them to command attractive premiums without needing tens of thousands of attendees.

As the industry doubles down on superfans — the highly engaged, high-spending listeners hungry for access —, this trend signals an opportunity at the intersection of exclusivity and intimacy: smaller-scale, premium music experiences designed not for the masses, but for the most devoted.

The three cases that follow — Sonorium, Cercle, and Fever’s Candlelight — illustrate how different players are betting on this shift. Rather than chase stadium crowds, these companies are building new rituals and business models around intimate, immersive, and highly curated music experiences. In the process, they are quietly redefining what concerts can sound and feel like.

Three visions for intimate music experiences

Sonorium: A home for mindful listening

Sonorium is a French startup that organizes immersive music listening sessions. Founded in 2019, it was formed from the reunion of The Slow Listener and Disco Alto, two companies that had launched earlier off the same concept.

Sonorium events aim to provide a superior listening experience. This goes down to a few components:

Hi-fi audio: Sonorium is focused on delivering the highest possible audio quality. On the hardware side, the company has worked with French high-end speaker manufacturers like Focal and Hark; on the software side, it uses high-resolution files from Qobuz, an audiophile music streaming company. One particular event also involved Ircam Amplify, a French audio tech company with deep expertise in spatial audio.

Context & commentary: For each session, Sonorium invites either the artist themselves, a close collaborator (e.g., their producer), or a music journalist to present the featured album and answer questions from the audience afterwards.

Location: To date, Sonorium has hosted sessions in 100+ prestigious sites in France — though most of them in Paris —, including Le Louvre, the Grand Palais, Centre Pompidou, and Jardin des Tuileries. Because most of these historical venues were not designed for music, Sonorium retrofits them for the duration of an event or, in the case of Le Louvre and Jardin des Tuileries, provides participants with individual bluetooth headphones so they can listen to the same program in sync while roaming freely.

Both the concept and the company itself are positioned firmly in opposition to the current state of music consumption. Where digitization has largely flattened audio quality, Sonorium uses state-of-the-art audiophile set-ups. Where music listening is now playlist-driven, Sonorium is bringing back the album as a cohesive and self-contained unit. Where discovery is algorithmic, Sonorium focuses on curation and context. Where music is mostly consumed alone and on the go, Sonorium makes it collective and sedentary. All in all, the company is betting on a slower and richer relationship to music and those who make it.

Its programming has so far spanned a wide spectrum of eras and genres. A look at past sessions on the company's website shows a healthy mix of cult names and albums — e.g., Kanye West's Graduation, Radiohead's OK Computer, The Fugees' The Score — as well as more up-and-coming artists. In line with Sonorium's roots, the latter category includes mostly French artists like L'Impératrice, La Femme, and others. In that regard, Sonorium's geographic and cultural proximity to these artists' and their labels will likely continue to influence which music the company features in its events.

Six years in and with a track record of over 130 sessions (98% of which sold out), Sonorium is now expanding into two directions.

On the one hand, the company now makes its concept available to music labels interested in connecting with fans for an album's release or anniversary. Through this offering, the labels get to engage fans in an intimate setting while leaning on Sonorium's years of experience as a turnkey event organizer. While the core concept remains the same, this offering likely presents a more attractive margin profile for Sonorium. For each of its usual, Sonorium-branded shows, the company would normally be required to pay a clearance fee to the music's owners — both the publisher and the label — for what is called the "public performance" of an album's recording. In contrast, label-supported shows are part of a partner's own marketing budget, what you might call "Fan Acquisition Cost". This essentially shifts Sonorium's costs (i.e., the rights clearance, the space rental, the staff...) onto the label, while Sonorium can take a commission for handling the logistics.

On the other hand, Sonorium plans to open the first venue specifically dedicated to music listening. It envisions "a comfortable space providing immersive audio (high-end speakers surrounding the audience with spatial audio) and visuals (projection mapping, light shows). A can't miss third place for a new kind of music listening, with an engaged community." The space would be open both during the day and in the evening, with album listening sessions available to all upon reservation, similar to a movie showing. Details are still being fleshed out, but in an open form aimed at music industry professionals, Sonorium suggested that the venue's capacity could be between 40 to 150 people.

These two initiatives are, of course, meant to be complementary. Sonorium's questionnaire emphasized privatization as a key destination and asked music professionals about their target use cases (e.g., previews, new releases, catalog), audiences (e.g. press, DSPs, internal, or fans), how often and when they might be interested in booking the venue, and how much they would be willing to pay per session (from <1,000€ to €2,000+). It also assessed the industry's interest in spatial audio (as opposed to stereo only), immersive visuals (in addition to just audio), and memberships as a way to lock in regular sessions. At a hypothetical €2,000 a session and with multiple sessions a day — though not all of them would be private —, this new activity could prove highly lucrative. Sonorium has also hinted to a potential bar and dining area, a notoriously high-margin add-on for entertainment businesses.

With this new chapter, Sonorium is making a bold wager: that in an era of infinite choice and shallow consumption, music still deserves intention and reverence. By creating the first permanent home for immersive listening, the company is positioning itself not only as a curator of taste but also as a long-term strategic partner for an industry hungry for authentic and memorable fan engagement.

Cercle: Aspirational dancefloors

Cercle is a premium music experience organizer and media company. In the company's own, more eloquent words:

Cercle is an artistic movement that hosts and curates experiences, events, festivals, a record label, and immersive musical journeys. At the intersection of music, aesthetics, heritage, and video, Cercle aims to create and produce innovative experiences on a global scale, highlighting unique artists on unique stages, offering a new perspective on the cultural and natural legacy of our world.

The vision wasn't always so encompassing. Founded in 2016, Cercle started out as a series of DJ sets and interviews uploaded to YouTube and informally set up out of founder Derek Barbolla's own Parisian apartment. When the noise complaints started pouring in, these shows moved to more suitable locations in Paris, from a restaurant's basement to a moving barge on the Seine. A breakthrough moment came in October 2016 with a live DJ set at the Eiffel Tower. The first of Cercle's shows to go viral, this show kicked off "Lundis Cercle" (French for "Cercle Mondays"), the company's long-running weekly series of live DJ sets staged in cultural heritage locations.

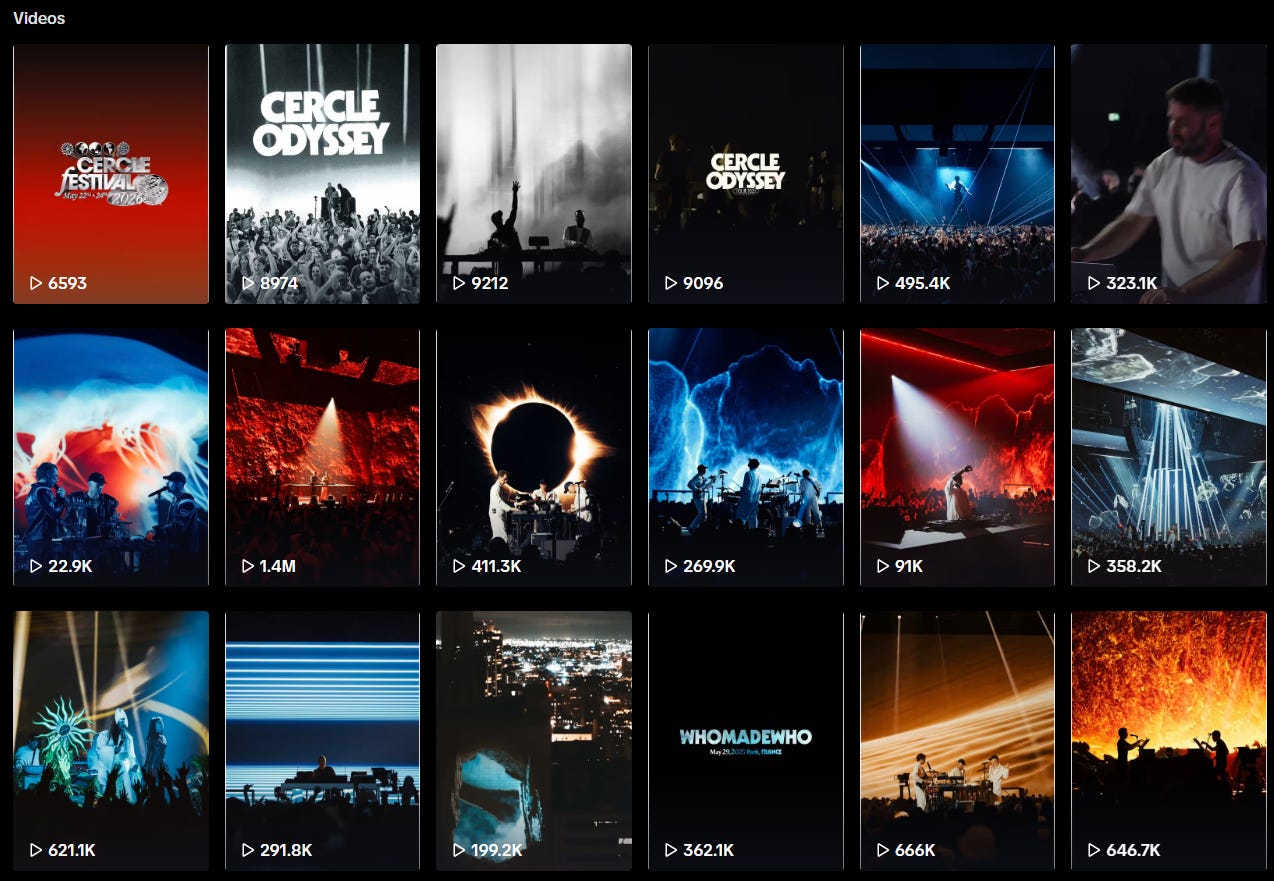

A lot has happened since then. In July 2022, Lundis Cercle transitioned from its intense weekly or bi-weekly shows to one per month, a shift towards more sustainable growth and larger, more complex projects. By 2024, the company had organized over 240 shows everywhere across the globe, each in a location more surprising than the last, from a French castle to a mountain peak, from a lighthouse to a heliport, from a salt flat to a moving hot balloon. Over the years, Cercle has gradually diversified into adjacent experiences and activities:

2019 : Cercle Festival, a 3-day music festival in France

2020: Cercle Records, a record label that releases music from Cercle artists

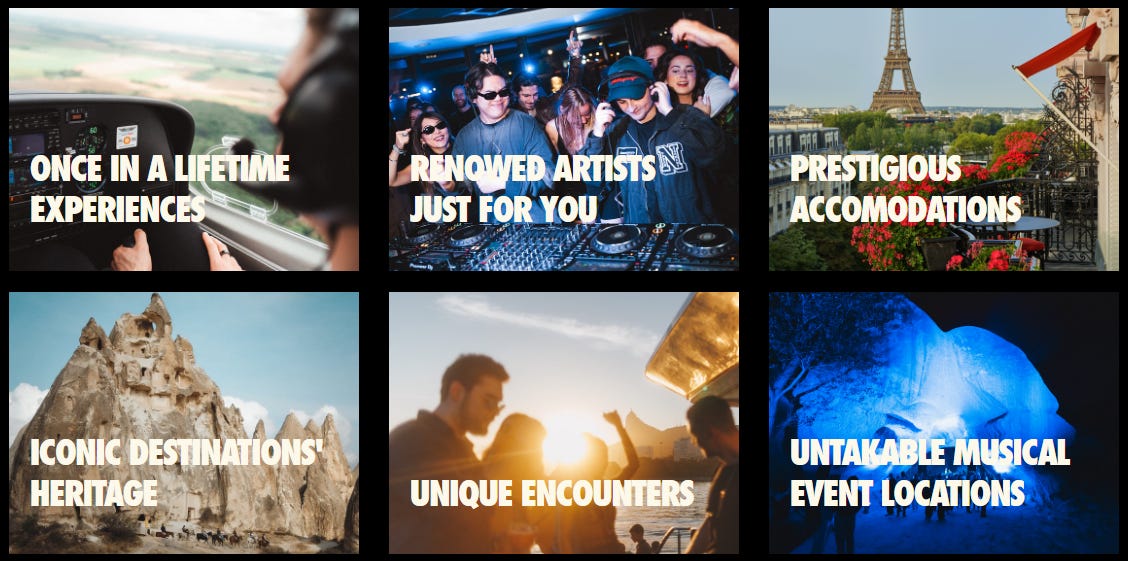

2022: Cercle Moment, exclusive, luxury travel and music experiences in remote destinations, combining private performances with curated activities

2024: Cercle Odyssey, a multi-city tour of immersive 360° concert experiences

Throughout this evolution, the company has quietly redefined the look and feel of live electronic music shows. Four key pillars explain how this transformation took shape.

Content-first ubiquity

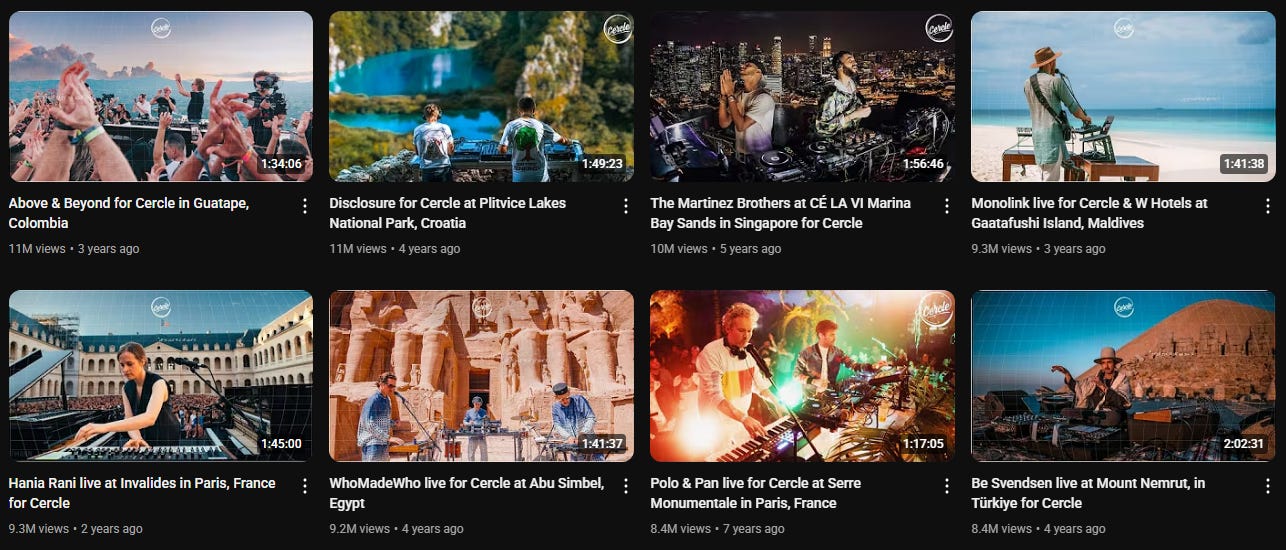

The remoteness of Cercle shows may make them inaccessible to most, but it was always balanced by the team's digital savvy. Born on YouTube, Cercle quickly expanded to other platforms in order to maximize reach and capitalize on emerging opportunities. Møme's October 2016 DJ set at the Eiffel Tower, which propelled the brand onto a global stage almost overnight, was the first show to leverage Facebook Live, then only a few months old. Today, Cercle boasts a combined following of roughly 7.2 million across platforms, including 3.5 million on its historical home base, YouTube.

This digital presence offers two major advantages. First, it likely generates meaningful revenue through the platforms' ad-sharing programs. Cercle's YouTube channel alone features over 260 videos, some of which have amassed tens of millions of views. DJ sets, by nature, encourage long watch time and high engagement, creating more opportunities for ads and boosting potential earnings. However, the team has emphasized in interviews that shifting platform algorithms and generally low CPMs make this income stream too volatile to rely on as a primary source.

More importantly, Cercle's content serves as the strongest entry point into its event portfolio — the true revenue engine of its business. While the company uses newsletters to directly notify fans of upcoming events, no channel travels as fast, scales as broadly, or sells tickets as effectively as its striking video content. With hundreds of hours of content, Cercle is now perfectly positioned to leverage short form-focused platforms like YouTube Shorts and TikTok for ongoing discovery.

A cohesive ecosystem

Cercle has strategically woven a brand universe where every initiative acts as both a self-contained experience and a promotional gateway to the rest of the company's offerings. As just mentioned, content was designated early on to be at the core of this strategy. Today, Cercle's shows, festival, and immersive tour are working hard to convert online, low-value viewers into on-the-ground, high-value participants. The relationship doesn't end there: Attendees often return online to rewatch the exact same set they experienced live, transforming a fleeting moment into a lasting memory and reigniting anticipation for future events. The more shows, the more footage, the greater the reach and the stronger the brand — and so the flywheel keeps going. Long-tail content can drive business just as efficiently as new releases. For example, the team updated even its oldest video descriptions to include links to upcoming Odyssey tour dates.

These various initiatives are unified not just commercially, but also semantically and aesthetically. Consistent naming conventions signal coherence and help build trust from one event to the next, while a shared visual language — a testament to founder Derek Barbolla's background in film — ties things together at both the video and portfolio level. To celebrate the simultaneous release of nine tracks on its in-house label Cercle Records, the company premiered Cercle Story, an anthology film "featuring 9 amazing artists, from 9 stunning locations with the idea of recreating a full day from sunrise to sunset around the world." This visual and narrative continuity helps turn casual viewers into loyal fans who actively seek out and advocate for the "Cercle feel" in both digital and physical settings.

Productized chaos

The frequency at which Cercle organizes and broadcasts these events belies their complexity. In that respect, success only made the team more ambitious over the years. Rather than rest on its laurels, Cercle continued to seek out ever more exceptional and more unreachable locations. The logistic impact is obvious: from location scouting to financing to day-of production, each show now requires on average about a year of preparation, sometimes two. The diversity in formats — interior vs. exterior, public vs. non-public — adds another layer of difficulty and prevents a one-size-fits-all approach. In the team's own words, "Every show comes with its own business model."

Still, that the company was able to not only go on but thrive is proof that there is a method to the madness. While Cercle may face extreme variability from one event to the next, it has demonstrated a rare operational discipline across its growing offering. Cercle Festival, Cercle Moments, and Cercle Odyssey not only built off the team's years of production expertise, they also drew from the same editorial tenets. Like the Lundis Cercle of old, they too rely on aggressive curation, focus on scenography, and look to convey a sense of place, scale, and awe. The requirements in time, capital, and equipment may vary greatly, but these ideas remain as guiding principles, helping turn an otherwise chaotic ambition into repeatable productions.

Music's luxury ladder

There's something else that the events have in common: their premium positioning. With its focus on electronic music and aspirational content, Cercle found a natural market in young, urban, and affluent audiences willing to shell out decent money for quality entertainment.

Admittedly, the diversity of Cercle's offering can make it hard to discuss pricing. On YouTube, non-public shows — where the artist is performing without an audience — make up a significant part of the company's portfolio. But as far as public shows go, the range appears fairly consistent across the board. This year, tickets for a 2-hour Cercle Odyssey show in Paris went for €100, while 3-day passes for the next year's edition of Cercle Festival are currently going for €270. People on Reddit have reported paying between $200-$400 for individual shows in New York, Mexico City, and other locations. Overall, this puts Cercle events in line or (well) above industry averages: according to Pollstar, the average ticket price for the top 100 tours in the world was $120 for the first 6 months of 2025.

Cercle fully entered luxury territory in 2022 with the launch of Cercle Moments, a new kind of travel experience that includes multiple private DJ sets per trip, 5-star accommodations, and location-specific activities spanning boat parties, wine tasting, and paragliding. The upcoming 4-day trip "Cappadocia Legacy" in Turkey, for example, will set participants back anywhere from €5,250 to €7,500, or between €1,300+ and €1,800 a day. With a capacity of 55 guests, that makes for a lucrative format.

Granted, not all of this will be profit. While Moments are all-inclusive from the participants' perspective, the team is actually covering some very high costs. By and large, I suspect that Cercle still makes the bulk of its revenue and profit off large-volume, lower-price formats like Odyssey and Cercle Festival. Still, the very existence of Cercle Moments is proof that the company's years of efforts building brand trust have paid off.

Overall, Cercle has built a global brand by turning striking, unexpected locations into unforgettable live stages. By blending music, travel, and aesthetics, it has created a unique form of entertainment that has proved to resonate with audiences far beyond traditional club or festival settings. With its latest initiative, the technology-enhanced Odyssey, the company is once again pushing the limits of what a music show is supposed to look like. This aligns with a broader move toward experiential culture, where music is expected to be not just heard but embodied.

Fever: Pop music with a classical touch

Fever is a global live entertainment discovery platform that designs, produces, operates, and markets cultural experiences. Its activities consist of four main segments:

Online marketplace

Fever operates a global event discovery and ticketing platform that lets users browse and book a wide range of local cultural experiences across sports, music, food, wellness, and immersive entertainment. The company is also the exclusive ticketing provider to prominent IP owners and event organizers, including FC Barcelona, Primavera Sound, and... Cercle! In June 2025, Fever acquired DICE, an independent music ticketing platform, to bolster its scale and capabilities in this area.

Events production and operations

Fever is directly involved in the production and operations of experiences, with a focus on immersive entertainment.

It does so in two ways. Historically, the company has worked with IP owners and entertainment specialists to co-produce live entertainment formats, including Harry Potter: A Forbidden Forest Experience with Warner Bros., JURASSIC WORLD: THE EXHIBITION with Universal Pictures, and Stranger Things: The Experience with Netflix.

In addition, Fever has also been developing its own range of original experiences, Fever Originals. (Despite the name, not all Fever Originals are owned by Fever alone — many of them are, in fact, co-productions.) Today, the category spans a wide spectrum of entertainment experiences, with a focus on multi-sensory and often technology-enabled concepts. This includes Paradox Museum, an immersive museum of optical illusions, Neon Brush, "a retro-futuristic pop-up painting workshop"; Bubble Planet, a multi-sensory immersive exhibition; and Candlelight Concerts, a series of intimistic, (battery-powered) "candle"-lit acoustic concerts; and many more.

Despite their thematic variety, all these formats share Fever's hallmark: they are deliberately social-first. From Neon Brush's glow-in-the-dark canvases to Bubble Planet's Insta-friendly backdrops, every detail is engineered for shareability and user-generated content, the lifeblood of modern cultural marketing. Fever doesn’t just rely on this organically: it systematically builds influencer programs into each experience, ensuring built-in distribution among digital-native audiences.

Scalability is Fever’s second foundational principle. By focusing on simple, high-appeal concepts, the startup creates experiences that can seed locally and then blossom into full-fledged franchises globally. Prison Island, for instance, now operates in over a dozen European cities, while Bubble Planet has already landed in 13 cities across Europe, the US, and APAC — with more in the pipeline. Combined with first-party data harvested from its marketplace, this modular approach allows Fever to identify high-potential markets and rapidly replicate its hits with precision.

Secret Media Network

Fever operates a sprawling ecosystem of over 200 hyper-local digital collectively attracting 300M+ monthly interactions. These channels serve a dual purpose. On the one hand, they generate revenue through a mix of branded content, giveaways, and email campaigns for third-party clients. On the other hand, they act as a powerful in-house marketing engine to drive discovery and ticket sales — particularly for Fever Originals, where the company captures margin not just as the ticketing provider but also as the event operator. Crucially, Fever's editorial control allows it to subtly prioritize its own experiences in supposedly neutral city guides, a tactic kept largely invisible to consumers who rarely realize that media and marketplace share the same parent company.

Fever For Business

Expanding beyond its consumer core, Fever launched Fever for Business, a dedicated corporate division to serve enterprise clients with custom-built private events and tailored experiential perks. This initiative transforms Fever from a pure ticketing and entertainment brand into a B2B partner capable of orchestrating turnkey branded gatherings and activations.

While the company arguably deserves its own deep dive, for the purpose of this piece, I'll focus on Candlelight Concerts.

Candlelight Concerts

As just discussed, Candlelight Concerts, or Candlelight for short, are "candle"-lit live acoustic concerts. In the company's own words:

Candlelight Concerts are a series of original music concerts created by Fever aimed at democratising the access to classical music. This innovative format represents a unique live musical experience through a varied offer of programs to meet all tastes, played by local musicians, in emblematic venues, with the space and performers illuminated by thousands of candles. Candlelight invites a broader audience that might have never considered a classical music concert before to connect with the most iconic pieces of the greatest composers and listen to the top hits of well-known artists in a different way.

Launched in Madrid in 2019 and now the crown jewel of Fever Originals, Candlelight is both the company’s most recognizable and, by all indications, its most successful concept to date. As of 2023, Fever reported active Candlelight shows in over 100 cities, reaching more than 3 million attendees — a figure that has almost certainly grown substantially since. Today, Fever claims partnerships with more than 2,000 venues worldwide, underscoring the franchise’s astonishing global scale.

In many ways, Candlelight perfectly encapsulates Fever's broader strategic playbook.

Built-in scalability

From its 2019 debut to today, Candlelight was meticulously engineered to scale. This global rollout hinges on an asset-light, highly replicable formula:

Broad, evolving repertoire: Originally conceived as a purely classical series (Vivaldi, Mozart, Chopin), Candlelight has since expanded into tributes to pop legends (Queen, ABBA, Coldplay, Ed Sheeran), genre-focused nights (R&B, K-pop, film scores), and seasonal specials (Christmas, Halloween, Valentine’s). Local variations — like a Charles Aznavour hommage in France — exist, but the overall editorial stance remains safely culture-agnostic.

Instrumental focus: Performances are instrumental-only, enabling seamless localization without linguistic barriers.

Short, repeatable format: A one-hour runtime lowers audience commitment while enabling two shows per night, maximizing venue yield.

Operational streamlining: Fever actively recruits new venues and artists through inbound forms on its official site, allowing it to rapidly prioritize high-potential cities and reduce market entry friction.

Integrated promotional machine: As with other Originals, Candlelight rides Fever’s full-stack marketing infrastructure — from affiliate and influencer programs to its Secret Media Network, which subtly plugs shows via seemingly neutral listicles and branded highlights. This mix of paid and owned media keeps Candlelight omnipresent and top-of-mind globally.

Of course, Candlelight’s model isn’t without friction. Sourcing "emblematic venues" remains a significant bottleneck, since many historic or cultural spaces may be reluctant to host heavily branded, social-first events that might clash with their public image. Convincing these partners requires careful negotiation and trust-building. Fever also faces the inevitable operational headaches of live events — vetting musicians, staffing, and last-minute crises. Yet, overall, Candlelight stands as a masterclass in strategic design and operational execution.

IP partnerships

While Candlelight is nominally a Fever Original, it smartly borrows from Fever’s broader IP partnership strategy. Beyond its core repertoire, the format has expanded into co-branded shows with entertainment giants eager to deepen fan engagement. In 2023, Fever launched Candlelight: 100 Years of Warner Bros., an international concert series spanning 100 venues and featuring iconic scores from franchises like Harry Potter, The Lord of the Rings, and Batman. In 2024, Fever teamed up with Netflix and Shondaland for a Bridgerton-themed show, reinterpreting series hits in a candlelit acoustic setting. These collaborations continue today, reinforcing Candlelight’s cultural relevance and refreshing its appeal beyond classical purists.

Beyond film and TV IP, Fever actively collaborates with music rights holders to diversify Candlelight’s creative palette. Tribute concerts remain the primary lever, repackaging artists’ catalogs into intimate acoustic tributes that resonate with superfans and casual listeners alike. Fever has also experimented with original artist showcases — for instance, a 2023 three-night special with Australian electro-pop artist JOY, who performed her own material in the Candlelight format. While still rare, these artist partnerships hint at a potent future use case: helping musicians and labels launch new music in a uniquely immersive, high-touch environment that traditional tours rarely match.

For Fever, these partnerships aren’t optional embellishments. While Candlelight initially pitched itself as a vehicle to “democratize classical music,” the reality is that audiences will only sit through so many Vivaldi or Mozart renditions. In fiercely competitive cities — take Paris, where pay-what-you-want classical concerts abound —, Candlelight needs fresh hooks to maintain cultural relevance. If Fever’s IP strategy is any indication, the company is not so much “democratizing classical music” as giving popular culture the "classical treatment" in a timeless aesthetic that feels premium and conversation-worthy.

Corporate events

As mentioned earlier, Fever has expanded into the corporate space through Fever for Business — a division designed to repackage its experiential catalog for private and enterprise clients. Among these, Candlelight is the star asset. In May 2025, Fever officially launched Candlelight for Business in the US, aiming to “[transform] traditional corporate events into immersive, multisensory live music experiences.” This offering invites brands to weave candlelit concerts into product launches, galas, milestone celebrations, and VIP gatherings, providing a ready-made premium atmosphere.

Fever underscores that these B2B iterations are fully bespoke — from repertoire curation to venue selection — to align seamlessly with each client’s brand narrative and objectives. Notable examples include a 2023 one-night collaboration with Apple to launch Apple Music Classical, and a recent Mastercard member-exclusive concert in New York designed as a loyalty perk. These projects illustrate Candlelight’s adaptability as a branded storytelling tool, not just a concert format.

From gala dinners to VIP receptions, product launches, film premieres, and industry conferences, countless brands are eager to deliver premium, conversation-sparking experiences for employees, partners, and clients. Traditionally, orchestrating such an event requires weeks of planning and coordination across a patchwork of vendors. By contrast, Fever for Business — in this instance, Candlelight for Business — offers a turnkey solution: a pre-packaged, highly polished cultural experience that brands can drop directly into their event calendar with minimal friction.

Candlelight took the codes of classical music and masterfully reframed them for a generation fluent in visual storytelling and hungry for experiential consumption. Building off a simple concept and with the help of Fever’s integrated operations and marketing infrastructure, it has grown into a versatile, scalable, and — from what little inside knowledge I was able to gather — highly profitable business. This success is proof that smaller-scale music experiences can thrive within a deliberately mainstream and global cultural vision.

Connecting the dots

Sonorium, Cercle, and Fever are reimagining music shows through radically different lenses. Having unpacked their unique backstories and visions, let’s examine the broader cultural and business opportunities they illuminate.

Thinking beyond sound

That music is a visual medium is hardly new. From MTV’s peak to YouTube’s endless stream of music videos, visuals have long helped propel songs into mainstream culture. As of June 2025, 5 of the top 10 videos on YouTube were music videos — 10 out of 10, if you count nursery rhymes. TikTok’s ascent then rewrote the rules, replacing label-produced polish with short-form user-generated. True to its musical.ly roots, music became the platform’s creative backbone. By 2023, 85% of TikTok videos featured music (up from 70% in 2019) and short-form video was the primary way (82%) in which 16-24s engaged with music, well ahead of audio streaming (72%). In 2024, 84% of Billboard Global 200 hits went viral on TikTok first. More than ever, songs are discovered as soundtracks to videos rather than as their pure audio selves.

But TikTok and YouTube only tell part of the story. Sonorium, Cercle, and Fever show that concerts, too, have become visual experiences. These companies are deliberately leaving behind traditional music venues and opting instead for less acoustically optimal but more majestic, singular, or unexpected locations that imbue their events with an air of exclusivity and help them command a premium. Location scouting is further enhanced by these companies’ production savvy. Fever’s "candles", Cercle’s wraparound LED screens and surreal visuals, and Sonorium’s hints at projection mapping for its upcoming venue all signal a move from mere listening to full multimedia immersion.

These visuals aren’t just for those present; they’re designed to entice everyone watching from afar. In a social-first world, word-of-mouth starts with the eye, and event organizers need to think deeply of how their shows will translate and resonate online. By doubling as Insta-worthy backdrops, these companies' carefully crafted atmospheres directly contribute to their business goals.

Framing perception

In theory, event organizers should chase maximum visibility. More exposure means more awareness, which should mean more ticket sales. Major festivals like Coachella and Glastonbury have certainly leaned into, and benefitted from, user-generated content (and FOMO). But such ubiquity, combined with the debatable quality of the average piece of UGC created at these events, can end up diluting an event's brand and ultimately hurting its desirability.

For their part, Sonorium, Cercle, and Fever know that controlling perception is as important as controlling the stage. The strict no-phone policy, for instance, isn't simply about “preserving the moment” for everyone involved. By restricting content creation to in-house teams, professional partners, and vetted influencers, these companies ensure that what circulates online is either meticulously produced or strategically aligned with their storytelling and business goals.

Yet even with this level of control, execution can falter. Cercle’s Odyssey is a case in point. To make sure that Odyssey participants would still be able to show off online despite not being allowed to film the event themselves, Cercle sent over a ... a Dropbox link with a few made-for-social photos and vertical snippets from the shows. Lacking both the cinematic polish of Cercle’s signature productions and the authenticity of raw UGC, the material left many unimpressed. This was a reminder that while curation protects brand equity, it also risks alienating audiences if it feels sterile or performative.

Scaling intimacy

The success of Sonorium, Cercle, and Fever hinges on a paradox.

On the one hand, these companies are obsessed with giving their events an atmosphere of intimacy. This is most obvious in the (relatively) small scale of their productions. Sonorium's future venue is set to host just 40-100+ people; Cercle's upcoming Cappadocia trip caps at "around 55 people, for a premium experience with the Cercle Family!" And while I wasn't able to find a definite number for Fever, I believe Candlelight concerts typically seat no more than 150-200 guests. This makes these shows closer to private showcases than to mass-market concerts.

But intimacy isn't just about headcount. An important corollary to size is the proximity to the artist — another focal point for the three companies. Sonorium ensures this connection by inviting the artist or a collaborator to discuss their work informally. Cercle's public shows place the DJ within arm's reach, even centering them on the dance floor as with Odyssey. Meanwhile, Fever emphasizes that, "compared to traditional classical performances", Candlelight attendees can interact with musicians between pieces — an unthinkable luxury at a packed arena show.

Yet intimacy alone doesn't pay the bills. While these companies aim for a white-glove feel, their business relies on their ability to scale. No matter how magical, a single event means nothing if it can't be replicated and monetized repeatedly. Scalability is made possible through aggressive standardization, whether it's in duration (e.g., Candlelight's hour-long shows), programming (e.g. "Hommage to Coldplay" everywhere), or processes (e.g., Fever's streamlined venue intake form). It also calls for adequate tooling, to avoid having to reinvent the wheel for every new production. On this front, Fever is at a clear advantage, as vertical integration puts it in total control of the distribution and monetization of its events. By contrast, Cercle's reliance on third-party ticketing exposes it to reputational risk when things go awry.

Building rituals

Scalability is about replicability — how to make an offering easy for a company to deploy rapidly and profitably. But as scalable as these formats are, they only work if audiences come back — repeatedly. Without retention, companies burn through early adopters and must constantly chase new faces, driving up acquisition costs and eroding returns. This begs the question: Are these events one-off spectacles, or can they become regular cultural rituals?

Retention, like scalability, sits on a spectrum. Cercle is firmly on the “one-off” end, as its remote, high-concept events are built for singular moments rather than repeat visits. By contrast, Fever’s Candlelight concerts are not just widespread thanks to Fever's already global footprint, but also frequent — virtually any artist- or genre-centric show in the Candlelight roster is performed one or several times each month. This availability, bolstered by the company's aggressive marketing, naturally offers more excuses to return.

Of the three, Sonorium is the most deliberate about fostering loyalty. As mentioned, it envisions audiences booking listening sessions as they would a cinema ticket. A teased subscription model, which would provide access to unlimited sessions per month, borrows directly from the film industry’s playbook, reframing immersive music listening as a habitual outing rather than a luxury splurge.

Of course, we can't discuss retention without addressing pricing — desire doesn’t matter if the wallet can’t keep up.

On this front, the three companies diverge sharply. Sonorium’s survey suggests a price range from under €10 to over €20. For comparison, roughly 83% of movie theater tickets sold in France last year — a good proxy considering the company's vision — cost less than 10€.

The pricing of Fever's Candlelight Concerts is harder to pinpoint, since it's influenced by factors like seating options, location (i.e. both the city and the specific venue), seasonality, and more. In Paris, “Hommage to Céline Dion” runs from €19 to €49; in Sydney, “The World of Joe Hisaishi” starts at $72 and climbs to $135 for premium seats. For context, a Paris opera ticket averaged €102 in 2024, while the top seats for a recital by world-renowned pianist Lang Lang went for €110. This positions Candlelight as an accessible luxury: affordable to some, yet forced to compete with more traditional high-end cultural options.

Cercle, meanwhile, lives at the "premium" extreme of the spectrum. Its local shows can vary, but the $7,500 Cercle Moment trips seal its positioning as a bucket-list indulgence. Like remoteness, high prices firmly anchor it in the “exceptional" category, inevitably limiting repeat attendance.

Concept over artist

While price and logistical friction shape repeat attendance, there’s a more fundamental axis at play: artist-centric versus concept-centric appeal. In other words: Are these events about whose music is playing, or about what the experience promises?

In an artist-centric model, fans show up because of the artist. They may have heard about an event locally, from fan communities they're part of, or from following the artist on social media or streaming platforms. In any case, due to both scarcity and price point, a concert stands as this high-commitment event that complements lower-touch interactions like social posts or simply streaming the artist's music.

In a concept-centric model, the entertainment format itself is the star. Consumers attend because they want the experience, regardless of who is playing. The artist is, if not indifferent, at least secondary. For example, many music fans report attending festivals religiously no matter the line-up: what they're after is "the festival experience", with its scenography and effervescence.

This distinction isn’t just theoretical; it has deep business implications.

In the first case, concert-goers will attend an event only because of its programming. A Coldplay fan might buy a Candlelight ticket for a Coldplay hommage, but wouldn’t show up for a Joe Hisaishi evening. This essentially forces event organizers to either feature only mainstream artists that they know have the greatest appeal possible (at the show level), or cast a wide and diverse enough net in terms of programming that they can still appeal to everyone in aggregate (across multiple shows). This dependence on top music IP makes them vulnerable when negotiating with third parties for talent (e.g., Cercle) and rights clearance (e.g., Sonorium and Fever).

A concept-centric configuration, on the other hand, gives organizers more freedom to experiment with curation and reduces their reliance on headline artists or major IP, enabling them to build loyalty around the format itself rather than the programming. Essentially, the stronger the concept’s own brand equity, the less reliant the company is on any single artist's name to draw in crowds.

Of course, it's not all black and white. Some concert-goers (or, I suspect, most of them) may really enjoy a concept but still only be willing to shell out if they're interested in the programming. Others may love an artist but have no interest in consuming their work in a certain form.

As discussed, even the most exciting concept is also competing for attention against a myriad other cultural options. Sonorium's success, for instance, hinges on its ability to convince people that slow, hi-fi listening is an entirely different (and better) experience than shuffling through a Spotify playlist of the same artist from the comfort of their homes. In that regard, a flipside of its approachability in both price and business model is that consumers may feel like the overall concept lacks exceptionality. To address those concerns, the company would need to highlight the things that make it truly destination-worthy, namely, spatial audio — although that too is now increasingly available at home — and the artist's presence.

Ultimately, Sonorium, Cercle, and Fever can’t just declare what matters more to audiences. But the more they can convince consumers to buy into their unique concepts — not just the music —, the easier it will become to build repeat audiences and ultimately control their own destinies.

Cultural touchpoints

Sonorium, Cercle, and Fever are building exciting businesses around unique concepts. Each in its own way, they are embracing music’s experiential shift and delighting fans with smaller, more exclusive gatherings where music feels part of a comprehensive creative vision.

Importantly, these companies are not merely cannibalizing existing concert formats but indeed unlocking new layers of consumer demand. With its upcoming venue, Sonorium is not taking business away from live stages but elevating the otherwise isolated state of recorded music listening. By taking electronic music out of the club and into cultural heritage sites, Cercle exposed it to crowds who might have never listened to it, let alone danced to it. As for Fever, considering Candlelight’s overall mainstream programming, it is not so much poaching patrons away from traditional orchestras as it is introducing classical culture to new audiences. By tapping new consumer behaviors, they are expanding the cultural and economic possibilities of the industry itself.

Sizing this opportunity borders on guesswork, but there are clear parallels. In tech, history shows that value tends to migrate to whoever operates closest to the end user — at the infamous “interface layer.” For their part, by designing and orchestrating where and how listeners experience music, Sonorium, Cercle, and Fever own a highly valuable cultural touchpoint.

Though being French admittedly makes me partial to Cercle and Sonorium, Fever seems the best positioned to thrive. Six years in, Candlelight continues to grow rapidly and open new territories, paving the way for more Originals, music-related or not. Today, Candlelight’s weekly pulse on what sells in 150 cities (and counting) gives Fever a living map of global taste. As labels and promoters scramble to derisk touring, they might need Fever’s global, asset-light, data-driven network more than it needs them.

Thank you for reading. If you’ve enjoyed this essay, please consider giving it a like and take a minute to share it with others. It really helps.

As always, I’d love to hear your thoughts! You can find me on Linkedin or on X, or just reply directly to this email.

Thanks to Jimmy for reviewing a draft of this piece.